Legendary investors such as Leon Cooperman and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those successful funds in these small-cap stocks. In the following paragraphs, we analyze Qiwi PLC (NASDAQ:QIWI) from the perspective of those successful funds.

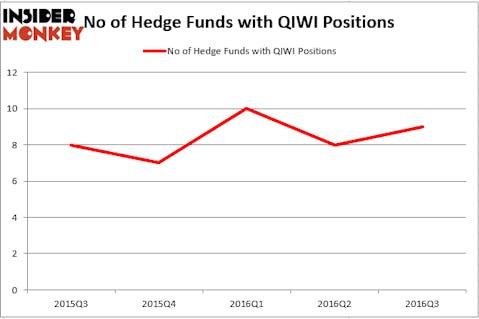

Qiwi PLC (NASDAQ:QIWI) has experienced an increase in enthusiasm from smart money in recent months. QIWI was in 9 hedge funds’ portfolios at the end of September. There were 8 hedge funds in our database with QIWI positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Teekay Corporation (NYSE:TK), EarthLink, Inc. (NASDAQ:ELNK), and Western Asst High Incm Opprtnty Fnd Inc. (NYSE:HIO) to gather more data points.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

bluebay/Shutterstock.com

What have hedge funds been doing with Qiwi PLC (NASDAQ:QIWI)?

At the end of the third quarter, a total of 9 of the hedge funds tracked by Insider Monkey held long positions in this stock, a gain of 13% from one quarter earlier. On the other hand, there were a total of 7 hedge funds with a bullish position in QIWI at the beginning of this year. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Kerr Neilson’s Platinum Asset Management has the largest position in Qiwi PLC (NASDAQ:QIWI), worth close to $61 million, corresponding to 1.4% of its total 13F portfolio. Sitting at the No. 2 spot is Renaissance Technologies, one of the biggest hedge funds in the world, with a $10.2 million position. Some other members of the smart money that are bullish contain Israel Englander’s Millennium Management, Mike Vranos’ Ellington and David Costen Haley’s HBK Investments. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now, specific money managers were breaking ground themselves. Ellington, led by Mike Vranos, assembled the biggest position in Qiwi PLC (NASDAQ:QIWI). Ellington had $0.7 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $0.3 million position during the quarter. Another fund with new position in the stock is Matthew Hulsizer’s PEAK6 Capital Management.

Let’s also examine hedge fund activity in other stocks similar to Qiwi PLC (NASDAQ:QIWI). We will take a look at Teekay Corporation (NYSE:TK), EarthLink, Inc. (NASDAQ:ELNK), Western Asst High Incm Opprtnty Fnd Inc. (NYSE:HIO), and Community Trust Bancorp, Inc. (NASDAQ:CTBI). This group of stocks’ market valuations are closest to QIWI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TK | 12 | 69990 | -3 |

| ELNK | 20 | 97904 | -2 |

| HIO | 4 | 7992 | -1 |

| CTBI | 4 | 8773 | -1 |

As you can see these stocks had an average of 10 hedge funds with bullish positions and the average amount invested in these stocks was $46 million. That figure was $75 million in QIWI’s case. EarthLink, Inc. (NASDAQ:ELNK) is the most popular stock in this table. On the other hand Western Asst High Incm Opprtnty Fnd Inc. (NYSE:HIO) is the least popular one with only 4 bullish hedge fund positions. Qiwi PLC (NASDAQ:QIWI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ELNK might be a better candidate to consider taking a long position in.

Disclosure: None