At Insider Monkey we follow around 740 of the top investors and even though many of them underperformed the raging bull market, the history teaches us that over the long-run they still manage to beat the market after adjusting for risk, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following their best picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

In this article, we’ll take a closer look at Polaris Industries Inc. (NYSE:PII), which registered a decline in the number of funds from our database holding long positions. At the end of September, 12 funds held shares of Polaris Industries. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Dun & Bradstreet Corp (NYSE:DNB), athenahealth, Inc (NASDAQ:ATHN), and Core Laboratories N.V. (NYSE:CLB) to gather more data points.

Follow Polaris Inc. (NYSE:PII)

Follow Polaris Inc. (NYSE:PII)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Yegor Larin/Shutterstock.com

With all of this in mind, we’re going to take a look at the fresh action regarding Polaris Industries Inc. (NYSE:PII).

How are hedge funds trading Polaris Industries Inc. (NYSE:PII)?

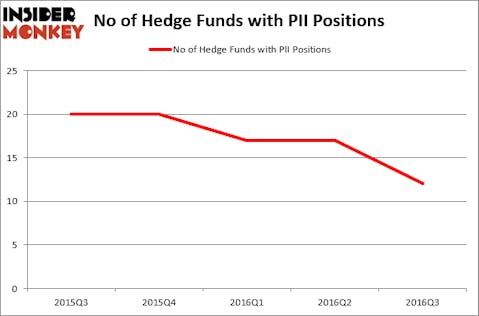

At the end of the third quarter, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, compared to 17 funds a quarter earlier. The graph below displays the number of hedge funds with bullish position in PII over the last five quarters. With hedgies’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Ken Fisher’s Fisher Asset Management has the most valuable position in Polaris Industries Inc. (NYSE:PII), worth close to $15.9 million, corresponding to less than 0.1%% of its total 13F portfolio. The second most bullish fund manager is Citadel Investment Group, led by Ken Griffin, holding a $15.7 million position; less than 0.1% of its 13F portfolio is allocated to the stock. Some other peers that hold long positions comprise Curtis Macnguyen’s Ivory Capital (Investment Mgmt) and Joel Greenblatt’s Gotham Asset Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Seeing as Polaris Industries Inc. (NYSE:PII) has witnessed falling interest from the entirety of the hedge funds we track, we can see that there exists a select few money managers that decided to sell off their positions entirely by the end of the third quarter. At the top of the heap, Robert Joseph Caruso’s Select Equity Group sold off the largest investment of all the hedgies monitored by Insider Monkey, totaling about $65.5 million in stock.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Polaris Industries Inc. (NYSE:PII) but similarly valued. We will take a look at Dun & Bradstreet Corp (NYSE:DNB), athenahealth, Inc (NASDAQ:ATHN), Core Laboratories N.V. (NYSE:CLB), and Donaldson Company, Inc. (NYSE:DCI). This group of stocks’ market caps resemble PII’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DNB | 21 | 236956 | 4 |

| ATHN | 15 | 156671 | -5 |

| CLB | 22 | 145268 | 1 |

| DCI | 12 | 130412 | 0 |

As you can see these stocks had an average of 18 funds with bullish positions and the average amount invested in these stocks was $167 million. That figure was $75 million in PII’s case. Core Laboratories N.V. (NYSE:CLB) is the most popular stock in this table. On the other hand Donaldson Company, Inc. (NYSE:DCI) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Polaris Industries Inc. (NYSE:PII) has the same level of popularity as DCI. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: none