We have been waiting for this for a year and finally the third quarter ended up showing a nice bump in the performance of small-cap stocks. Both the S&P 500 and Russell 2000 were up since the end of the second quarter, but small-cap stocks outperformed the large-cap stocks by double digits. This is important for hedge funds, which are big supporters of small-cap stocks, because their investors started pulling some of their capital out due to poor recent performance. It is very likely that equity hedge funds will deliver better risk adjusted returns in the second half of this year. In this article we are going to look at how this recent market trend affected the sentiment of hedge funds towards PNC Financial Services Group Inc (NYSE:PNC), and what that likely means for the prospects of the company and its stock.

PNC Financial Services Group Inc (NYSE:PNC) investors should be aware of an increase in support from the world’s most elite money managers recently. At the end of this article we will also compare PNC to other stocks including America Movil SAB de CV (ADR) (NYSE:AMX), Raytheon Company (NYSE:RTN), and Northrop Grumman Corporation (NYSE:NOC) to get a better sense of its popularity.

Follow Pnc Financial Services Group Inc. (NYSE:PNC)

Follow Pnc Financial Services Group Inc. (NYSE:PNC)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Rawpixel.com/Shutterstock.com

With all of this in mind, let’s take a glance at the recent action regarding PNC Financial Services Group Inc (NYSE:PNC).

Hedge fund activity in PNC Financial Services Group Inc (NYSE:PNC)

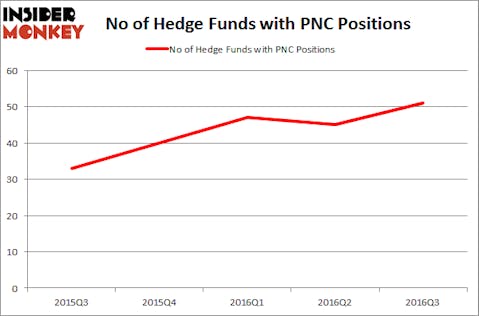

During the third quarter, the number of funds tracked by Insider Monkey long PNC Financial Services Group appreciated by 13% to 51. With hedge funds’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Cliff Asness’ AQR Capital Management has the biggest position in PNC Financial Services Group Inc (NYSE:PNC), worth close to $492 million, amounting to 0.8% of its total 13F portfolio. The second most bullish fund manager is Adage Capital Management, led by Phill Gross and Robert Atchinson, holding a $185.1 million position; 0.5% of its 13F portfolio is allocated to the stock. Some other professional money managers that are bullish contain David E. Shaw’s D E Shaw, Israel Englander’s Millennium Management, and Ric Dillon’s Diamond Hill Capital.

Consequently, specific money managers were leading the bulls’ herd. Balyasny Asset Management, led by Dmitry Balyasny, established the most valuable position in PNC Financial Services Group Inc (NYSE:PNC). Balyasny Asset Management had $95.7 million invested in the company at the end of the quarter. Robert Pitts’s Steadfast Capital Management also made a $56.6 million investment in the stock during the third quarter. The other funds with new positions in the stock are David Tepper’s Appaloosa Management LP, Ken Griffin’s Citadel Investment Group, and Anand Parekh’s Alyeska Investment Group.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as PNC Financial Services Group Inc (NYSE:PNC) but similarly valued. We will take a look at America Movil SAB de CV (ADR) (NYSE:AMX), Raytheon Company (NYSE:RTN), Northrop Grumman Corporation (NYSE:NOC), and ING Groep N.V. (ADR) (NYSE:ING). This group of stocks’ market values are closest to PNC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AMX | 11 | 268831 | -2 |

| RTN | 36 | 1038218 | -2 |

| NOC | 37 | 1229934 | -7 |

| ING | 12 | 58872 | -2 |

As you can see these stocks had an average of 24 funds with bullish positions at the end of September and the average amount invested in these stocks was $649 million. That figure was $.189 billion in PNC’s case. Northrop Grumman Corporation (NYSE:NOC) is the most popular stock in this table, while America Movil SAB de CV (ADR) (NYSE:AMX) is the least popular one with only 11 investors holding shares. Compared to these stocks PNC Financial Services Group Inc (NYSE:PNC) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.