Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the fourth quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 5 years and analyze what the smart money thinks of Playa Hotels & Resorts N.V. (NASDAQ:PLYA) based on that data.

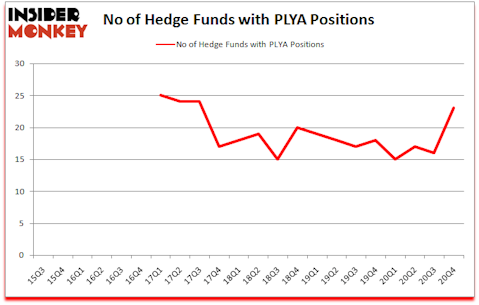

Is PLYA stock a buy? Playa Hotels & Resorts N.V. (NASDAQ:PLYA) was in 23 hedge funds’ portfolios at the end of December. The all time high for this statistic is 25. PLYA investors should pay attention to an increase in support from the world’s most elite money managers of late. There were 16 hedge funds in our database with PLYA holdings at the end of September. Our calculations also showed that PLYA isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

In the eyes of most investors, hedge funds are viewed as worthless, old financial tools of the past. While there are more than 8000 funds in operation today, We choose to focus on the leaders of this club, approximately 850 funds. It is estimated that this group of investors administer the majority of all hedge funds’ total asset base, and by keeping an eye on their highest performing equity investments, Insider Monkey has identified a few investment strategies that have historically outrun the broader indices. Insider Monkey’s flagship short hedge fund strategy outrun the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 197% since March 2017 (through March 2021) and beat the S&P 500 Index by 124 percentage points. You can download a sample issue of this newsletter on our website .

Michael Price of MFP Investors

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, auto parts business is a recession resistant business, so we are taking a closer look at this discount auto parts stock that is growing at a 196% annualized rate. We go through lists like the 15 best micro-cap stocks to buy now to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. With all of this in mind let’s take a look at the recent hedge fund action surrounding Playa Hotels & Resorts N.V. (NASDAQ:PLYA).

Do Hedge Funds Think PLYA Is A Good Stock To Buy Now?

At Q4’s end, a total of 23 of the hedge funds tracked by Insider Monkey were long this stock, a change of 44% from one quarter earlier. By comparison, 18 hedge funds held shares or bullish call options in PLYA a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

More specifically, Farallon Capital was the largest shareholder of Playa Hotels & Resorts N.V. (NASDAQ:PLYA), with a stake worth $89.2 million reported as of the end of December. Trailing Farallon Capital was HG Vora Capital Management, which amassed a stake valued at $44.6 million. Redwood Capital Management, Empyrean Capital Partners, and Millennium Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Marlowe Partners allocated the biggest weight to Playa Hotels & Resorts N.V. (NASDAQ:PLYA), around 9.14% of its 13F portfolio. General Equity Partners is also relatively very bullish on the stock, earmarking 4.88 percent of its 13F equity portfolio to PLYA.

As aggregate interest increased, key hedge funds were leading the bulls’ herd. Solel Partners, managed by Craig Peskin and Peter Fleiss, established the biggest position in Playa Hotels & Resorts N.V. (NASDAQ:PLYA). Solel Partners had $14.8 million invested in the company at the end of the quarter. David Rosen’s Rubric Capital Management also made a $13.1 million investment in the stock during the quarter. The following funds were also among the new PLYA investors: Michael Kahan and Jeremy Kahan’s North Peak Capital, Leonard Green’s Leonard Green & Partners, and David Brown’s Hawk Ridge Management.

Let’s go over hedge fund activity in other stocks similar to Playa Hotels & Resorts N.V. (NASDAQ:PLYA). These stocks are ACCO Brands Corporation (NYSE:ACCO), Adecoagro SA (NYSE:AGRO), Federal Agricultural Mortgage Corp. (NYSE:AGM), MGP Ingredients Inc (NASDAQ:MGPI), WisdomTree Investments, Inc. (NASDAQ:WETF), Ebang International Holdings Inc. (NASDAQ:EBON), and Forrester Research, Inc. (NASDAQ:FORR). This group of stocks’ market values match PLYA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ACCO | 17 | 45325 | 3 |

| AGRO | 10 | 203385 | 0 |

| AGM | 11 | 15419 | 0 |

| MGPI | 13 | 27668 | 2 |

| WETF | 17 | 71562 | -5 |

| EBON | 3 | 1260 | 2 |

| FORR | 8 | 96682 | 0 |

| Average | 11.3 | 65900 | 0.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.3 hedge funds with bullish positions and the average amount invested in these stocks was $66 million. That figure was $301 million in PLYA’s case. ACCO Brands Corporation (NYSE:ACCO) is the most popular stock in this table. On the other hand Ebang International Holdings Inc. (NASDAQ:EBON) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Playa Hotels & Resorts N.V. (NASDAQ:PLYA) is more popular among hedge funds. Our overall hedge fund sentiment score for PLYA is 87.6. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks returned 12.3% in 2021 through April 19th but still managed to beat the market by 0.9 percentage points. Hedge funds were also right about betting on PLYA as the stock returned 23.5% since the end of December (through 4/19) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Playa Hotels & Resorts N.v. (NASDAQ:PLYA)

Follow Playa Hotels & Resorts N.v. (NASDAQ:PLYA)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.