The worries about the election and the ongoing uncertainty about the path of interest-rate increases have been keeping investors on the sidelines. Of course, most hedge funds and other asset managers have been underperforming main stock market indices since the middle of 2015. Interestingly though, smaller-cap stocks registered their best performance relative to the large-capitalization stocks since the end of the June quarter, suggesting that this may be the best time to take a cue from their stock picks. In fact, the Russell 2000 Index gained more than 15% since the beginning of the third quarter, while the Standard and Poor’s 500 benchmark returned less than 6%. This article will lay out and discuss the hedge fund and institutional investor sentiment towards Pinnacle Financial Partners (NASDAQ:PNFP).

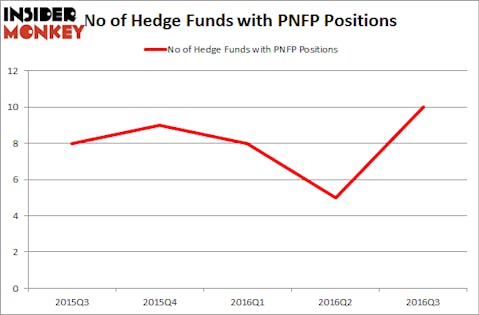

Is Pinnacle Financial Partners (NASDAQ:PNFP) going to take off soon? The smart money is thoroughly taking a bullish view. The number of long hedge fund bets that are revealed through 13F filings jumped by 5 recently. At the end of this article we will also compare PNFP to other stocks including Compass Minerals International, Inc. (NYSE:CMP), TCF Financial Corporation (NYSE:TCB), and Kosmos Energy Ltd (NYSE:KOS) to get a better sense of its popularity.

Follow Pinnacle Financial Partners Inc (NASDAQ:PNFP)

Follow Pinnacle Financial Partners Inc (NASDAQ:PNFP)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Kevin George/Shutterstock.com

What does the smart money think about Pinnacle Financial Partners (NASDAQ:PNFP)?

At Q3’s end, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 100% jump from one quarter earlier. By comparison, 9 hedge funds held shares or bullish call options in PNFP heading into this year, so hedge fund sentiment is now slightly improved for the year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Renaissance Technologies, one of the largest hedge funds in the world, has the largest position in Pinnacle Financial Partners (NASDAQ:PNFP), worth close to $7.4 million. On Renaissance Technologies’ heels is Mark Lee of Forest Hill Capital, with a $4.8 million position; the fund has 2.3% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that hold long positions consist of Richard Driehaus’ Driehaus Capital, Paul Hondros’ AlphaOne Capital Partners, and Bernard Horn’s Polaris Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.