We at Insider Monkey have gone over 742 13F filings that hedge funds and prominent investors are required to file by the government. The 13F filings show the funds’ and investors’ portfolio positions as of September 30. In this article, we look at what those funds think of PG&E Corporation (NYSE:PCG) based on that data.

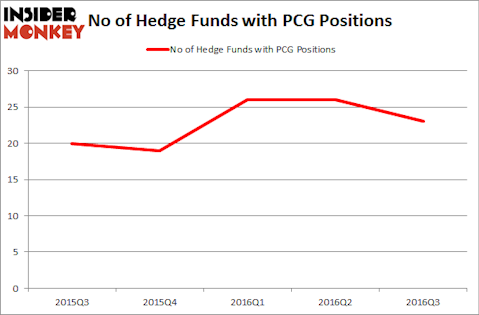

Is PG&E Corporation (NYSE:PCG) an exceptional stock to buy now? Prominent investors are taking a pessimistic view. The number of bullish hedge fund positions fell by 3 in recent months. PCG was in 23 hedge funds’ portfolios at the end of September. There were 26 hedge funds in our database with PCG positions at the end of the previous quarter. At the end of this article we will also compare PCG to other stocks including Prudential Financial Inc (NYSE:PRU), Liberty Global PLC LiLAC Class C (NASDAQ:LILAK), and Air Products & Chemicals, Inc. (NYSE:APD) to get a better sense of its popularity.

Follow Pg&E Corp (NYSE:PCG)

Follow Pg&E Corp (NYSE:PCG)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

chungking/Shutterstock.com

Hedge fund activity in PG&E Corporation (NYSE:PCG)

At the end of the third quarter, a total of 23 of the hedge funds tracked by Insider Monkey were bullish on this stock, down by 12% from the previous quarter after flat sentiment in Q2. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Israel Englander’s Millennium Management has the biggest position in PG&E Corporation (NYSE:PCG), worth close to $389.9 million. On Millennium Management’s heels is AQR Capital Management, led by Cliff Asness, holding a $218.1 million position. Other hedge funds and institutional investors that are bullish contain Phill Gross and Robert Atchinson’s Adage Capital Management, Jonathan Barrett and Paul Segal’s Luminus Management, and Dmitry Balyasny’s Balyasny Asset Management.

Due to the fact that PG&E Corporation (NYSE:PCG) has witnessed declining sentiment from the entirety of the hedge funds we track, it’s easy to see that there is a sect of hedge funds that decided to sell off their entire stakes heading into Q4. Interestingly, Jonathan Barrett and Paul Segal’s Luminus Management sold off the biggest position of all the hedgies followed by Insider Monkey, totaling close to $81.8 million in stock, and Glenn Russell Dubin’s Highbridge Capital Management was right behind this move, as the fund dropped about $33.5 million worth of PCG shares. These transactions are important to note, as aggregate hedge fund interest dropped by 3 funds heading into Q4.

Let’s now review hedge fund activity in other stocks similar to PG&E Corporation (NYSE:PCG). We will take a look at Prudential Financial Inc (NYSE:PRU), Liberty Global PLC LiLAC Class C (NASDAQ:LILAK), Air Products & Chemicals, Inc. (NYSE:APD), and Wipro Limited (ADR) (NYSE:WIT). This group of stocks’ market values match PCG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PRU | 28 | 520358 | -7 |

| LILAK | 43 | 941029 | -19 |

| APD | 56 | 4335573 | 0 |

| WIT | 8 | 104570 | 2 |

As you can see these stocks had an average of 34 hedge funds with bullish positions and the average amount invested in these stocks was $1.48 billion. That figure was $1.09 billion in PCG’s case. Air Products & Chemicals, Inc. (NYSE:APD) is the most popular stock in this table. On the other hand Wipro Limited (ADR) (NYSE:WIT) is the least popular one with only 8 bullish hedge fund positions. PG&E Corporation (NYSE:PCG) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard APD might be a better candidate to consider taking a long position in.

Disclosure: None