In this article we will analyze whether Peloton Interactive, Inc. (NASDAQ:PTON) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market by double digits annually.

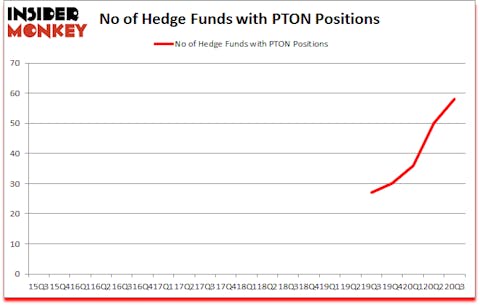

Is Peloton (PTON) a good stock to buy now? Money managers were taking an optimistic view. The number of bullish hedge fund positions went up by 8 recently. Peloton Interactive, Inc. (NASDAQ:PTON) was in 58 hedge funds’ portfolios at the end of the third quarter of 2020. The all time high for this statistics is 50. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that PTON isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks). There were 50 hedge funds in our database with PTON holdings at the end of June.

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 113% since March 2017 and outperformed the S&P 500 ETFs by more than 66 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets. Tesla’s stock price skyrocketed, yet lithium prices are still below their 2019 highs. So, we are checking out this lithium stock right now. We go through lists like the 15 best blue chip stocks to buy to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Now let’s check out the fresh hedge fund action encompassing Peloton Interactive, Inc. (NASDAQ:PTON).

What have hedge funds been doing with Peloton Interactive, Inc. (NASDAQ:PTON)?

Heading into the fourth quarter of 2020, a total of 58 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 16% from the previous quarter. By comparison, 27 hedge funds held shares or bullish call options in PTON a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

More specifically, Tiger Global Management LLC was the largest shareholder of Peloton Interactive, Inc. (NASDAQ:PTON), with a stake worth $771.9 million reported as of the end of September. Trailing Tiger Global Management LLC was Coatue Management, which amassed a stake valued at $510.2 million. Whale Rock Capital Management, Woodson Capital Management, and Woodson Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Woodson Capital Management allocated the biggest weight to Peloton Interactive, Inc. (NASDAQ:PTON), around 16.32% of its 13F portfolio. Woodson Capital Management is also relatively very bullish on the stock, designating 15.87 percent of its 13F equity portfolio to PTON.

Consequently, some big names have jumped into Peloton Interactive, Inc. (NASDAQ:PTON) headfirst. Chescapmanager LLC, managed by Traci Lerner, created the most valuable position in Peloton Interactive, Inc. (NASDAQ:PTON). Chescapmanager LLC had $84.3 million invested in the company at the end of the quarter. John Overdeck and David Siegel’s Two Sigma Advisors also initiated a $33.5 million position during the quarter. The other funds with new positions in the stock are Eduardo Costa’s Calixto Global Investors, Clint Carlson’s Carlson Capital, and Joe DiMenna’s ZWEIG DIMENNA PARTNERS.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Peloton Interactive, Inc. (NASDAQ:PTON) but similarly valued. We will take a look at Eversource Energy (NYSE:ES), CRH PLC (NYSE:CRH), Zimmer Biomet Holdings Inc (NYSE:ZBH), Chunghwa Telecom Co., Ltd (NYSE:CHT), ANSYS, Inc. (NASDAQ:ANSS), Moderna, Inc. (NASDAQ:MRNA), and Kinder Morgan Inc (NYSE:KMI). This group of stocks’ market valuations match PTON’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ES | 20 | 308177 | -8 |

| CRH | 7 | 61870 | 0 |

| ZBH | 55 | 1130301 | -7 |

| CHT | 5 | 149365 | 1 |

| ANSS | 40 | 1456264 | 0 |

| MRNA | 32 | 690338 | -5 |

| KMI | 46 | 939696 | -4 |

| Average | 29.3 | 676573 | -3.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.3 hedge funds with bullish positions and the average amount invested in these stocks was $677 million. That figure was $3498 million in PTON’s case. Zimmer Biomet Holdings Inc (NYSE:ZBH) is the most popular stock in this table. On the other hand Chunghwa Telecom Co., Ltd (NYSE:CHT) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Peloton Interactive, Inc. (NASDAQ:PTON) is more popular among hedge funds. Our overall hedge fund sentiment score for PTON is 90. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks returned 31.6% in 2020 through December 2nd but still managed to beat the market by 16 percentage points. Hedge funds were also right about betting on PTON as the stock returned 14% since the end of September (through 12/2) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Peloton Interactive Inc. (NASDAQ:PTON)

Follow Peloton Interactive Inc. (NASDAQ:PTON)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.