Looking for high-potential stocks? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 7.6% in the 12 months ending November 21, with more than 51% of the stocks in the index failing to beat the benchmark. Therefore, the odds that one will pin down a winner by randomly picking a stock are less than the odds in a fair coin-tossing game. Conversely, best performing hedge funds’ 30 preferred mid-cap stocks generated a return of 18% during the same 12-month period. Coincidence? It might happen to be so, but it is unlikely. Our research covering a 17-year period indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Paratek Pharmaceuticals Inc (NASDAQ:PRTK) .

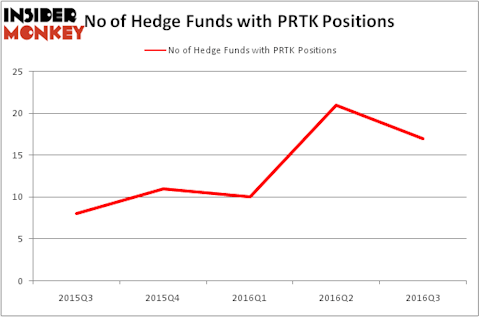

Paratek Pharmaceuticals Inc (NASDAQ:PRTK) has seen a decrease in activity from the world’s largest hedge funds in recent months. At the end of September, 17 funds tracked by Insider Monkey held long positions in PRTK, versus 21 funds that had been bullish on the stock at the end of June. However, the level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity, but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Adaptimmune Therapeutics PLC – ADR (NASDAQ:ADAP), Easterly Acquisition Corp (NASDAQ:EACQ), and Kratos Defense & Security Solutions, Inc (NASDAQ:KTOS) to gather more data points.

Follow Paratek Pharmaceuticals Inc. (NASDAQ:PRTK)

Follow Paratek Pharmaceuticals Inc. (NASDAQ:PRTK)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Keeping this in mind, we’re going to take a glance at the fresh action surrounding Paratek Pharmaceuticals Inc (NASDAQ:PRTK).

How are hedge funds trading Paratek Pharmaceuticals Inc (NASDAQ:PRTK)?

At the end of September, 17 funds tracked by Insider Monkey held long positions in Paratek Pharmaceuticals, down by 19% over the quarter. On the other hand, there were a total of 11 hedge funds with a bullish position in PRTK at the beginning of this year. With hedgies’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Seth Klarman’s Baupost Group has the number one position in Paratek Pharmaceuticals Inc (NASDAQ:PRTK), worth close to $26.6 million, comprising 0.4% of its total 13F portfolio. Coming in second is Kevin Kotler’s Broadfin Capital holding a $10.2 million position; 0.9% of its 13F portfolio is allocated to the company. Some other members of the smart money that are bullish contain Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management, Dennis Purcell’s Aisling Capital and Jim Roumell’s Roumell Asset Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.