The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards NorthWestern Corporation (NASDAQ:NWE).

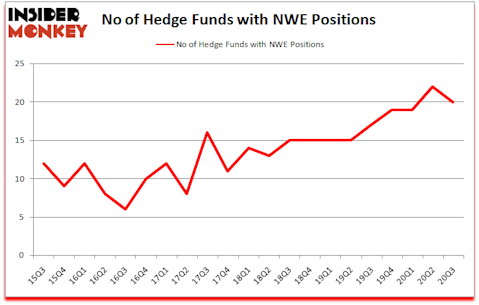

Is NWE a good stock to buy now? NorthWestern Corporation (NASDAQ:NWE) has experienced a decrease in hedge fund sentiment lately. NorthWestern Corporation (NASDAQ:NWE) was in 20 hedge funds’ portfolios at the end of the third quarter of 2020. The all time high for this statistic is 22. There were 22 hedge funds in our database with NWE positions at the end of the second quarter. Our calculations also showed that NWE isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 66 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in stocks that are in our short portfolio.

Donald Sussman of Paloma Partners

With all of this in mind let’s take a peek at the fresh hedge fund action regarding NorthWestern Corporation (NASDAQ:NWE).

Do Hedge Funds Think NWE Is A Good Stock To Buy Now?

At third quarter’s end, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -9% from the second quarter of 2020. The graph below displays the number of hedge funds with bullish position in NWE over the last 21 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Cliff Asness’s AQR Capital Management has the biggest position in NorthWestern Corporation (NASDAQ:NWE), worth close to $25.3 million, accounting for less than 0.1%% of its total 13F portfolio. Sitting at the No. 2 spot is GAMCO Investors, managed by Mario Gabelli, which holds a $13.9 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Some other professional money managers that are bullish encompass Renaissance Technologies, Israel Englander’s Millennium Management and Noam Gottesman’s GLG Partners. In terms of the portfolio weights assigned to each position Newtyn Management allocated the biggest weight to NorthWestern Corporation (NASDAQ:NWE), around 1.06% of its 13F portfolio. GAMCO Investors is also relatively very bullish on the stock, setting aside 0.15 percent of its 13F equity portfolio to NWE.

Judging by the fact that NorthWestern Corporation (NASDAQ:NWE) has faced a decline in interest from hedge fund managers, it’s easy to see that there is a sect of fund managers that decided to sell off their entire stakes heading into Q4. At the top of the heap, Michael Gelband’s ExodusPoint Capital dropped the biggest stake of all the hedgies tracked by Insider Monkey, valued at an estimated $1.5 million in stock, and David Harding’s Winton Capital Management was right behind this move, as the fund said goodbye to about $1.1 million worth. These transactions are intriguing to say the least, as total hedge fund interest dropped by 2 funds heading into Q4.

Let’s check out hedge fund activity in other stocks similar to NorthWestern Corporation (NASDAQ:NWE). These stocks are Bloom Energy Corporation (NYSE:BE), Uniti Group Inc. (NASDAQ:UNIT), Itron, Inc. (NASDAQ:ITRI), Sensient Technologies Corporation (NYSE:SXT), ABM Industries, Inc. (NYSE:ABM), CarGurus, Inc. (NASDAQ:CARG), and Stepan Company (NYSE:SCL). This group of stocks’ market caps match NWE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BE | 17 | 176049 | 1 |

| UNIT | 22 | 351956 | 5 |

| ITRI | 15 | 276452 | 2 |

| SXT | 22 | 219122 | -1 |

| ABM | 18 | 48485 | -3 |

| CARG | 32 | 328264 | 1 |

| SCL | 12 | 46672 | -3 |

| Average | 19.7 | 206714 | 0.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.7 hedge funds with bullish positions and the average amount invested in these stocks was $207 million. That figure was $101 million in NWE’s case. CarGurus, Inc. (NASDAQ:CARG) is the most popular stock in this table. On the other hand Stepan Company (NYSE:SCL) is the least popular one with only 12 bullish hedge fund positions. NorthWestern Corporation (NASDAQ:NWE) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for NWE is 50.3. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 30.7% in 2020 through December 14th and still beat the market by 15.8 percentage points. Hedge funds were also right about betting on NWE as the stock returned 15.8% since the end of Q3 (through 12/14) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Northwestern Corp (NASDAQ:NWE)

Follow Northwestern Corp (NASDAQ:NWE)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.