The 800+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the second quarter, which unveil their equity positions as of September 30th. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards NortonLifeLock Inc. (NASDAQ:NLOK).

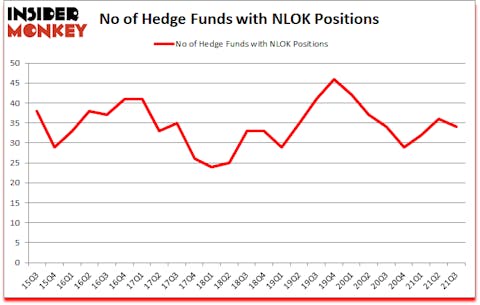

NortonLifeLock Inc. (NASDAQ:NLOK) shareholders have witnessed a decrease in hedge fund sentiment of late. NortonLifeLock Inc. (NASDAQ:NLOK) was in 34 hedge funds’ portfolios at the end of September. The all time high for this statistic is 46. There were 36 hedge funds in our database with NLOK positions at the end of the second quarter. Our calculations also showed that NLOK isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings).

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Now let’s take a glance at the new hedge fund action encompassing NortonLifeLock Inc. (NASDAQ:NLOK).

Do Hedge Funds Think NLOK Is A Good Stock To Buy Now?

At Q3’s end, a total of 34 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -6% from one quarter earlier. On the other hand, there were a total of 34 hedge funds with a bullish position in NLOK a year ago. With hedge funds’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Jeffrey Smith’s Starboard Value LP has the largest position in NortonLifeLock Inc. (NASDAQ:NLOK), worth close to $422.6 million, amounting to 7.7% of its total 13F portfolio. The second largest stake is held by Lyrical Asset Management, managed by Andrew Wellington and Jeff Keswin, which holds a $204.6 million position; the fund has 2.6% of its 13F portfolio invested in the stock. Other professional money managers that are bullish include Ryan Tolkin (CIO)’s Schonfeld Strategic Advisors, Jim Simons (founder)’s Renaissance Technologies and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital. In terms of the portfolio weights assigned to each position 59 North Capital allocated the biggest weight to NortonLifeLock Inc. (NASDAQ:NLOK), around 15.53% of its 13F portfolio. Totem Point Management is also relatively very bullish on the stock, earmarking 9.93 percent of its 13F equity portfolio to NLOK.

Since NortonLifeLock Inc. (NASDAQ:NLOK) has faced bearish sentiment from hedge fund managers, it’s easy to see that there lies a certain “tier” of hedgies that decided to sell off their entire stakes last quarter. It’s worth mentioning that David Cohen and Harold Levy’s Iridian Asset Management cut the largest stake of the “upper crust” of funds watched by Insider Monkey, comprising close to $182.5 million in stock, and Jinghua Yan’s TwinBeech Capital was right behind this move, as the fund dropped about $4.6 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest fell by 2 funds last quarter.

Let’s also examine hedge fund activity in other stocks similar to NortonLifeLock Inc. (NASDAQ:NLOK). We will take a look at Plug Power, Inc. (NASDAQ:PLUG), CenterPoint Energy, Inc. (NYSE:CNP), Arch Coal Inc (NYSE:ACI), Apollo Global Management Inc (NYSE:APO), Shaw Communications Inc (NYSE:SJR), Interpublic Group of Companies Inc (NYSE:IPG), and monday.com Ltd. (NASDAQ:MNDY). All of these stocks’ market caps are similar to NLOK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PLUG | 20 | 360413 | -14 |

| CNP | 14 | 134303 | -6 |

| ACI | 21 | 4509519 | 1 |

| APO | 47 | 2593894 | 10 |

| SJR | 21 | 892625 | -2 |

| IPG | 31 | 643159 | 0 |

| MNDY | 17 | 495191 | 17 |

| Average | 24.4 | 1375586 | 0.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.4 hedge funds with bullish positions and the average amount invested in these stocks was $1376 million. That figure was $1297 million in NLOK’s case. Apollo Global Management Inc (NYSE:APO) is the most popular stock in this table. On the other hand CenterPoint Energy, Inc. (NYSE:CNP) is the least popular one with only 14 bullish hedge fund positions. NortonLifeLock Inc. (NASDAQ:NLOK) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for NLOK is 55.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 28.6% in 2021 through November 30th and beat the market again by 5.6 percentage points. Unfortunately NLOK wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on NLOK were disappointed as the stock returned -1.3% since the end of September (through 11/30) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Gen Digital Inc. (NASDAQ:GEN)

Follow Gen Digital Inc. (NASDAQ:GEN)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Largest Entertainment Companies

- 11 Best Casino and Gambling Stocks To Buy Now

- 15 Largest Gas Companies In The US

Disclosure: None. This article was originally published at Insider Monkey.