At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

Hedge fund interest in Newfield Exploration Co. (NYSE:NFX) shares was flat at the end of last quarter. This isn’t necessarily a negative indicator. We use the level and the change in hedge fund popularity and compare this with the popularity of other stocks with similar market capitalization. A stock may witness a decline in popularity but it may still be more popular than similarly priced stocks. At the end of this article we will examine the hedge fund popularity of companies such as Dr. Reddy’s Laboratories Limited (ADR) (NYSE:RDY), Michael Kors Holdings Ltd (NYSE:KORS), and Amdocs Limited (NYSE:DOX) to gather more data points.

Follow Newfield Exploration Co (NYSE:NFX)

Follow Newfield Exploration Co (NYSE:NFX)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year, involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs.

Adwo/Shutterstock.com

Now, we’re going to take a look at the fresh action encompassing Newfield Exploration Co. (NYSE:NFX).

What does the smart money think about Newfield Exploration Co. (NYSE:NFX)?

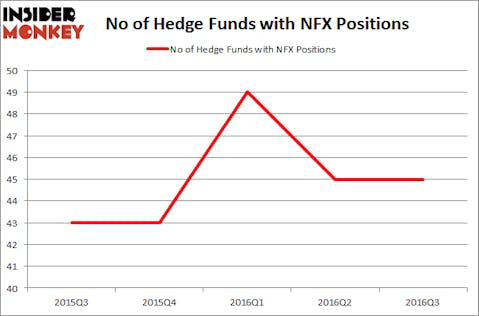

At the end of the third quarter, a total of 45 of the hedge funds tracked by Insider Monkey held long positions in this stock, unchanged from one quarter earlier. NFX was at peak popularity during the first quarter of this year when it was trading below $30. With the smart money’s sentiment swirling, there exists an “upper tier” of key hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Conatus Capital Management, run by David Stemerman, holds the most valuable position in Newfield Exploration Co. (NYSE:NFX). The fund reportedly holds an $88.5 million position in the stock, comprising 5.8% of its 13F portfolio. Sitting at the No. 2 spot is Carlson Capital, managed by Clint Carlson, which holds a $73.9 million position; 0.9% of its 13F portfolio is allocated to the stock. Other hedge funds and institutional investors with similar optimism include Anand Parekh’s Alyeska Investment Group, Cliff Asness’s AQR Capital Management and John Overdeck and David Siegel’s Two Sigma Advisors.

Seeing as Newfield Exploration Co. (NYSE:NFX) has experienced unchanged sentiment from hedge fund managers, we should take a look at a select few fund managers that slashed their positions entirely in the third quarter. Interestingly, Stuart J. Zimmer’s Zimmer Partners dumped the biggest position of the 700 funds tracked by Insider Monkey, worth an estimated $45.3 million in stock. Vince Maddi and Shawn Brennan’s fund, SIR Capital Management, also dropped its stock, about $29.9 million worth of NFX shares. These transactions are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Newfield Exploration Co. (NYSE:NFX) but similarly valued. These stocks are Dr. Reddy’s Laboratories Limited (ADR) (NYSE:RDY), Michael Kors Holdings Ltd (NYSE:KORS), Amdocs Limited (NYSE:DOX), and Cemex SAB de CV (ADR) (NYSE:CX). This group of stocks’ market caps are similar to NFX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RDY | 9 | 421800 | 2 |

| KORS | 31 | 583806 | 2 |

| DOX | 24 | 602590 | 4 |

| CX | 24 | 532753 | 5 |

As you can see these stocks had an average of 22 hedge funds with bullish positions and the average amount invested in these stocks was $535 million. That figure was $738 million in NFX’s case. Michael Kors Holdings Ltd (NYSE:KORS) is the most popular stock in this table. On the other hand Dr. Reddy’s Laboratories Limited (ADR) (NYSE:RDY) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Newfield Exploration Co. (NYSE:NFX) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: none.