Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility and underperformance. The time period between the end of June 2015 and the end of June 2016 was one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have been underperforming the large-cap indices. However, things have dramatically changed over the last 5 months. Small-cap stocks reversed their misfortune and beat the large cap indices by almost 11 percentage points since the end of June. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of New Oriental Education & Tech Grp (ADR) (NYSE:EDU) .

Overall, the hedge fund interest towards New Oriental Education & Tech Grp (ADR) (NYSE:EDU) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare EDU to other stocks, including Hyatt Hotels Corporation (NYSE:H), FactSet Research Systems Inc. (NYSE:FDS), and Nordstrom, Inc. (NYSE:JWN) to get a better sense of its popularity.

Follow New Oriental Education & Technology Group Inc. (NYSE:EDU)

Follow New Oriental Education & Technology Group Inc. (NYSE:EDU)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Sarawut Aiemsinsuk/Shutterstock.com

How are hedge funds trading New Oriental Education & Tech Grp (ADR) (NYSE:EDU)?

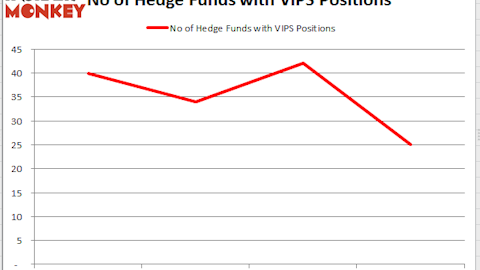

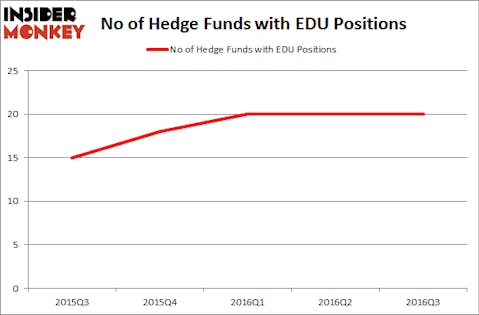

At the end of the third quarter, a total of 20 funds tracked by Insider Monkey held long positions in this stock, unchanged from the end of the second quarter. Below, you can check out the change in hedge fund sentiment towards EDU over the last five quarters. With hedgies’ capital changing hands, there exists a select group of key hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Ted Kang’s Kylin Management has the largest position in New Oriental Education & Tech Grp (ADR) (NYSE:EDU), worth close to $71.8 million, accounting for 14% of its total 13F portfolio. The second largest stake is held by Thomas E. Claugus’ GMT Capital holding a $41 million position. Remaining members of the smart money that hold long positions include Jim Simons’ Renaissance Technologies, Larry Chen and Terry Zhang’s Tairen Capital and Rob Citrone’s Discovery Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We already know that not all hedge funds are bullish on the stock and some hedge funds actually said goodbye to their positions entirely. It’s worth mentioning that Ernest Chow and Jonathan Howe’s Sensato Capital Management said goodbye to the biggest position of the 700 funds followed by Insider Monkey, comprising close to $17.5 million in stock, and Richard Driehaus’ Driehaus Capital was right behind this move, as the fund cut about $16.4 million worth of shares.

Let’s now review hedge fund activity in other stocks similar to New Oriental Education & Tech Grp (ADR) (NYSE:EDU). These stocks are Hyatt Hotels Corporation (NYSE:H), FactSet Research Systems Inc. (NYSE:FDS), Nordstrom, Inc. (NYSE:JWN), and Domino’s Pizza, Inc. (NYSE:DPZ). This group of stocks’ market valuations are closest to EDU’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| H | 23 | 293258 | 5 |

| FDS | 16 | 280411 | 1 |

| JWN | 30 | 282280 | 4 |

| DPZ | 33 | 1071671 | 0 |

As you can see these stocks had an average of 26 hedge funds with bullish positions and the average amount invested in these stocks was $482 million, compared to $289 million in EDU’s case. Domino’s Pizza, Inc. (NYSE:DPZ) is the most popular stock in this table. On the other hand FactSet Research Systems Inc. (NYSE:FDS) is the least popular one with only 16 bullish hedge fund positions. New Oriental Education & Tech Grp (ADR) (NYSE:EDU) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard Domino’s Pizza, Inc. (NYSE:DPZ) might be a better candidate to consider taking a long position in.

Disclosure: None