The elite funds run by legendary investors such as Dan Loeb and David Tepper make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentive to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Monolithic Power Systems, Inc. (NASDAQ:MPWR) from the perspective of those elite funds.

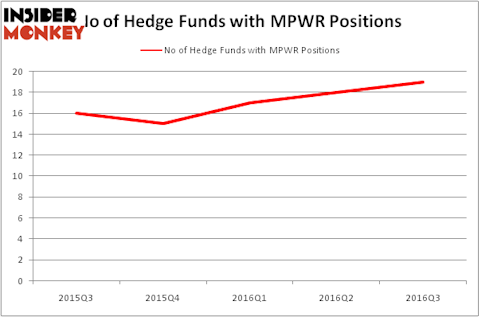

Is Monolithic Power Systems, Inc. (NASDAQ:MPWR) a buy here? Investors who are in the know are in an optimistic mood. The number of long hedge fund bets moved up by 1 in recent months. MPWR was in 19 hedge funds’ portfolios at the end of the third quarter of 2016. There were 18 hedge funds in our database with MPWR positions at the end of the previous quarter. At the end of this article we will also compare MPWR to other stocks including Graham Holdings Co (NYSE:GHC), Ellie Mae Inc (NYSE:ELLI), and Tenet Healthcare Corp (NYSE:THC) to get a better sense of its popularity.

Follow Monolithic Power Systems Inc (NASDAQ:MPWR)

Follow Monolithic Power Systems Inc (NASDAQ:MPWR)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Wichy/Shutterstock.com

Hedge fund activity in Monolithic Power Systems, Inc. (NASDAQ:MPWR)

Heading into the fourth quarter of 2016, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a gain of 6% from the second quarter of 2016, and the third-straight quarter during which hedge fund ownership rose. With the smart money’s sentiment swirling, there exists a few key hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Phill Gross and Robert Atchinson’s Adage Capital Management has the biggest position in Monolithic Power Systems, Inc. (NASDAQ:MPWR), worth close to $65 million. The second-most bullish fund manager is Carlson Capital, managed by Clint Carlson, which holds a $42.7 million position. Remaining members of the smart money that hold long positions consist of Alex Sacerdote’s Whale Rock Capital Management, Jim Simons’ Renaissance Technologies and Charles Clough’s Clough Capital Partners.