The financial regulations require hedge funds and wealthy investors that exceeded the $100 million equity holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on September 30th, about a month before the elections. We at Insider Monkey have made an extensive database of more than 817 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Magnolia Oil & Gas Corporation (NYSE:MGY) based on those filings.

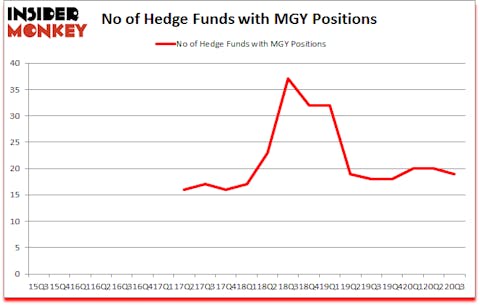

Is MGY a good stock to buy now? Magnolia Oil & Gas Corporation (NYSE:MGY) was in 19 hedge funds’ portfolios at the end of September. The all time high for this statistic is 37. MGY investors should pay attention to a decrease in hedge fund interest lately. There were 20 hedge funds in our database with MGY holdings at the end of June. Our calculations also showed that MGY isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are a multitude of methods market participants employ to value their holdings. Two of the most innovative methods are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the top picks of the top money managers can beat the S&P 500 by a significant amount (see the details here).

Keeping this in mind we’re going to analyze the new hedge fund action surrounding Magnolia Oil & Gas Corporation (NYSE:MGY).

Do Hedge Funds Think MGY Is A Good Stock To Buy Now?

At third quarter’s end, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -5% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards MGY over the last 21 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Encompass Capital Advisors was the largest shareholder of Magnolia Oil & Gas Corporation (NYSE:MGY), with a stake worth $23.7 million reported as of the end of September. Trailing Encompass Capital Advisors was Omega Advisors, which amassed a stake valued at $13.7 million. Arrowstreet Capital, Millennium Management, and SIR Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Encompass Capital Advisors allocated the biggest weight to Magnolia Oil & Gas Corporation (NYSE:MGY), around 2.11% of its 13F portfolio. SIR Capital Management is also relatively very bullish on the stock, designating 1.61 percent of its 13F equity portfolio to MGY.

Since Magnolia Oil & Gas Corporation (NYSE:MGY) has experienced a decline in interest from the aggregate hedge fund industry, it’s easy to see that there exists a select few hedge funds that elected to cut their entire stakes by the end of the third quarter. It’s worth mentioning that Noam Gottesman’s GLG Partners cut the largest position of all the hedgies monitored by Insider Monkey, worth about $1.1 million in stock, and Anand Parekh’s Alyeska Investment Group was right behind this move, as the fund sold off about $0.8 million worth. These transactions are important to note, as aggregate hedge fund interest dropped by 1 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Magnolia Oil & Gas Corporation (NYSE:MGY) but similarly valued. These stocks are Core-Mark Holding Company, Inc. (NASDAQ:CORE), Broadmark Realty Capital Inc. (NYSE:BRMK), Mesa Laboratories, Inc. (NASDAQ:MLAB), Nurix Therapeutics, Inc. (NASDAQ:NRIX), Weis Markets, Inc. (NYSE:WMK), Arbor Realty Trust, Inc. (NYSE:ABR), and AMC Networks Inc (NASDAQ:AMCX). This group of stocks’ market valuations are similar to MGY’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CORE | 20 | 45034 | 5 |

| BRMK | 11 | 85821 | 3 |

| MLAB | 8 | 104292 | -6 |

| NRIX | 12 | 249630 | 12 |

| WMK | 15 | 46048 | -4 |

| ABR | 11 | 49249 | 5 |

| AMCX | 28 | 218917 | 2 |

| Average | 15 | 114142 | 2.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $114 million. That figure was $87 million in MGY’s case. AMC Networks Inc (NASDAQ:AMCX) is the most popular stock in this table. On the other hand Mesa Laboratories, Inc. (NASDAQ:MLAB) is the least popular one with only 8 bullish hedge fund positions. Magnolia Oil & Gas Corporation (NYSE:MGY) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for MGY is 46.9. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 30.7% in 2020 through December 14th and still beat the market by 15.8 percentage points. Hedge funds were also right about betting on MGY as the stock returned 45.1% since the end of Q3 (through 12/14) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Magnolia Oil & Gas Corp (NYSE:MGY)

Follow Magnolia Oil & Gas Corp (NYSE:MGY)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.