A market surge in the first quarter, spurred by easing global macroeconomic concerns and Powell’s pivot ended up having a positive impact on the markets and many hedge funds as a result. The stocks of smaller companies which were especially hard hit during the fourth quarter slightly outperformed the market during the first quarter. Unfortunately, Trump is unpredictable and volatility returned in the second quarter and smaller-cap stocks went back to selling off. We finished compiling the latest 13F filings to get an idea about what hedge funds are thinking about the overall market as well as individual stocks. In this article we will study the hedge fund sentiment to see how those concerns affected their ownership of Menlo Therapeutics Inc. (NASDAQ:MNLO) during the quarter.

Is Menlo Therapeutics Inc. (NASDAQ:MNLO) a good stock to buy now? Investors who are in the know are betting on the stock. The number of long hedge fund bets advanced by 2 recently. Our calculations also showed that mnlo isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Nathan Fischel of DAFNA Capital

Let’s take a peek at the recent hedge fund action surrounding Menlo Therapeutics Inc. (NASDAQ:MNLO).

What does smart money think about Menlo Therapeutics Inc. (NASDAQ:MNLO)?

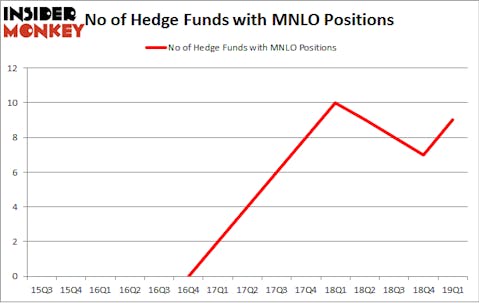

At the end of the first quarter, a total of 9 of the hedge funds tracked by Insider Monkey were long this stock, a change of 29% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards MNLO over the last 15 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

Among these funds, Vivo Capital held the most valuable stake in Menlo Therapeutics Inc. (NASDAQ:MNLO), which was worth $31.5 million at the end of the first quarter. On the second spot was Great Point Partners which amassed $16.1 million worth of shares. Moreover, Baker Bros. Advisors, OrbiMed Advisors, and DAFNA Capital Management were also bullish on Menlo Therapeutics Inc. (NASDAQ:MNLO), allocating a large percentage of their portfolios to this stock.

Consequently, specific money managers were leading the bulls’ herd. OrbiMed Advisors, managed by Samuel Isaly, assembled the most valuable position in Menlo Therapeutics Inc. (NASDAQ:MNLO). OrbiMed Advisors had $5 million invested in the company at the end of the quarter. Nathaniel August’s Mangrove Partners also made a $4.4 million investment in the stock during the quarter. The only other fund with a new position in the stock is James E. Flynn’s Deerfield Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Menlo Therapeutics Inc. (NASDAQ:MNLO) but similarly valued. These stocks are Neon Therapeutics, Inc. (NASDAQ:NTGN), VBI Vaccines, Inc. (NASDAQ:VBIV), Flexsteel Industries, Inc. (NASDAQ:FLXS), and PRGX Global Inc (NASDAQ:PRGX). This group of stocks’ market caps match MNLO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NTGN | 5 | 11325 | 1 |

| VBIV | 6 | 54748 | -1 |

| FLXS | 5 | 32010 | -1 |

| PRGX | 5 | 59115 | -1 |

| Average | 5.25 | 39300 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5.25 hedge funds with bullish positions and the average amount invested in these stocks was $39 million. That figure was $69 million in MNLO’s case. VBI Vaccines, Inc. (NASDAQ:VBIV) is the most popular stock in this table. On the other hand Neon Therapeutics, Inc. (NASDAQ:NTGN) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Menlo Therapeutics Inc. (NASDAQ:MNLO) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately MNLO wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on MNLO were disappointed as the stock returned -16.9% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.