The worries about the election and the ongoing uncertainty about the path of interest-rate increases have been keeping investors on the sidelines. Of course, most hedge funds and other asset managers have been underperforming main stock market indices since the middle of 2015. Interestingly though, smaller-cap stocks registered their best performance relative to the large-capitalization stocks since the end of the June quarter, suggesting that this may be the best time to take a cue from their stock picks. In fact, the Russell 2000 Index gained more than 15% since the beginning of the third quarter, while the Standard and Poor’s 500 benchmark returned less than 6%. This article will lay out and discuss the hedge fund and institutional investor sentiment towards Liberty Global PLC LiLAC Class C (NASDAQ:LILAK).

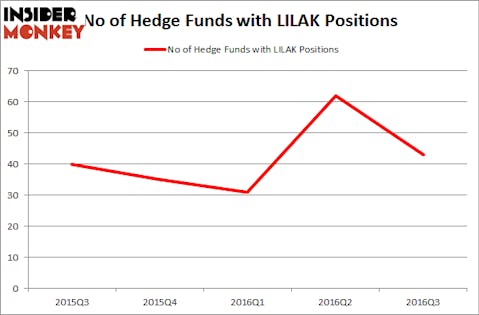

Is Liberty Global PLC LiLAC Class C (NASDAQ:LILAK) a healthy stock for your portfolio? The smart money seems to be getting less bullish. The number of long hedge fund bets declined by 19 during the third quarter and the company was included in the equity portfolios of 43 funds from our database at the end of September. However, the level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Air Products & Chemicals, Inc. (NYSE:APD), Wipro Limited (ADR) (NYSE:WIT), and Liberty Global PLC LiLAC Class A (NASDAQ:LILA) to gather more data points.

Follow Liberty Global Ltd.

Follow Liberty Global Ltd.

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

EvgeniiAnd/Shutterstock.com

Now, let’s check out the new action surrounding Liberty Global PLC LiLAC Class C (NASDAQ:LILAK).

How are hedge funds trading Liberty Global PLC LiLAC Class C (NASDAQ:LILAK)?

At the end of September, a total of 43 hedge funds tracked by Insider Monkey were bullish on this stock, down by 31% from the end of the previous quarter. With the smart money’s capital changing hands, there exists an “upper tier” of key hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Eagle Capital Management, led by Boykin Curry, holds the biggest position in Liberty Global PLC LiLAC Class C (NASDAQ:LILAK). Eagle Capital Management has a $154.6 million position in the stock, comprising 0.7% of its 13F portfolio. Sitting at the No. 2 spot is John Griffin’s Blue Ridge Capital, which holds a $112.5 million position; 1.3% of its 13F portfolio is allocated to the stock. Remaining members of the smart money that hold long positions include John H. Scully’s SPO Advisory Corp, Jeffrey Tannenbaum’s Fir Tree and J Kevin Kenny Jr’s Emerging Sovereign Group.

Seeing as Liberty Global PLC LiLAC Class C (NASDAQ:LILAK) has experienced bearish sentiment from the entirety of the hedge funds we track, we can see that there was a specific group of hedgies who were dropping their positions entirely in the third quarter. Interestingly, First Eagle Investment Management said goodbye to the biggest position of the 700 funds tracked by Insider Monkey, totaling close to $76.4 million in stock, and Will Snellings’ Marianas Fund Management was right behind this move, as the fund dumped about $34.2 million worth of shares. These bearish behaviors are interesting, as total hedge fund interest fell by 19 funds in the third quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Liberty Global PLC LiLAC Class C (NASDAQ:LILAK) but similarly valued. We will take a look at Air Products & Chemicals, Inc. (NYSE:APD), Wipro Limited (ADR) (NYSE:WIT), Liberty Global PLC LiLAC Class A (NASDAQ:LILA), and IntercontinentalExchange Inc (NYSE:ICE). This group of stocks’ market values match LILAK’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| APD | 56 | 4335573 | 0 |

| WIT | 8 | 104570 | 2 |

| LILA | 39 | 350427 | -12 |

| ICE | 47 | 2397109 | -2 |

As you can see these stocks had an average of 38 hedge funds with bullish positions at the end of September and the average amount invested in these stocks was $1.80 billion, which compares to $941 million in LILAK’s case. Air Products & Chemicals, Inc. (NYSE:APD) is the most popular stock in this table. On the other hand Wipro Limited (ADR) (NYSE:WIT) is the least popular one with only 8 bullish hedge fund positions. Liberty Global PLC LiLAC Class C (NASDAQ:LILAK) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal, but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard Air Products & Chemicals, Inc. (NYSE:APD) might be a better candidate to consider a long position.