A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on Koppers Holdings Inc. (NYSE:KOP).

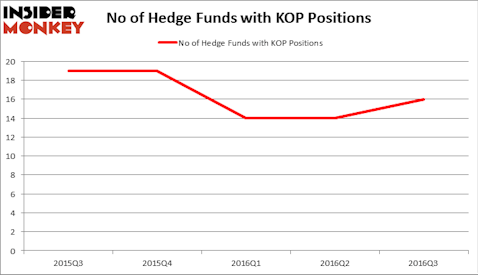

Koppers Holdings Inc. (NYSE:KOP) shareholders have witnessed an increase in activity from the world’s largest hedge funds of late. KOP was in 21 hedge funds’ portfolios at the end of September. There were 14 hedge funds in our database with KOP holdings at the end of the previous quarter. At the end of this article we will also compare KOP to other stocks including Novadaq Technologies Inc. (NASDAQ:NVDQ), Eldorado Resorts Inc (NASDAQ:ERI), and Northstar Realty Europe Corp (NYSE:NRE) to get a better sense of its popularity.

Follow Koppers Holdings Inc. (NYSE:KOP)

Follow Koppers Holdings Inc. (NYSE:KOP)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

bluebay/Shutterstock.com

What does the smart money think about Koppers Holdings Inc. (NYSE:KOP)?

At Q3’s end, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, up by 14% from the second quarter of 2016. Below, you can check out the change in hedge fund sentiment towards KOP over the last 5 quarters. With hedge funds’ sentiment swirling, there exists a select group of key hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Jeremy Carton and Gilbert Li’s Alta Fundamental Advisers has the largest position in Koppers Holdings Inc. (NYSE:KOP), worth close to $16.9 million, corresponding to 20.8% of its total 13F portfolio. On Alta Fundamental Advisers’ heels is Mountain Lake Investment Management, led by Mitch Cantor, holding a $15.3 million position; 8.8% of its 13F portfolio is allocated to the company. Other members of the smart money that hold long positions consist of Nelson Obus’ Wynnefield Capital, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and Renaissance Technologies, one of the largest hedge funds in the world. We should note that Mountain Lake Investment Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Consequently, specific money managers have been driving this bullishness. Gotham Asset Management, led by Joel Greenblatt, initiated the biggest position in Koppers Holdings Inc. (NYSE:KOP). Gotham Asset Management had $0.8 million invested in the company at the end of the quarter. Matthew Tewksbury’s Stevens Capital Management also initiated a $0.4 million position during the quarter. The only other fund with a brand new KOP position is Robert B. Gillam’s McKinley Capital Management.

Let’s check out hedge fund activity in other stocks similar to Koppers Holdings Inc. (NYSE:KOP). We will take a look at Novadaq Technologies Inc. (NASDAQ:NVDQ), Eldorado Resorts Inc (NASDAQ:ERI), Northstar Realty Europe Corp (NYSE:NRE), and New York Mortgage Trust, Inc. (NASDAQ:NYMT). This group of stocks’ market values are similar to KOP’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NVDQ | 9 | 81711 | 1 |

| ERI | 22 | 207294 | 0 |

| NRE | 13 | 152594 | -5 |

| NYMT | 3 | 1860 | 0 |

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $111 million. That figure was $59 million in KOP’s case. Eldorado Resorts Inc (NASDAQ:ERI) is the most popular stock in this table. On the other hand New York Mortgage Trust, Inc. (NASDAQ:NYMT) is the least popular one with only 3 bullish hedge fund positions. Koppers Holdings Inc. (NYSE:KOP) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ERI might be a better candidate to consider taking a long position in.

Disclosure: None