Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts usually don’t make them change their opinion towards a company. This time it may be different. The coronavirus pandemic destroyed the high correlations among major industries and asset classes. We are now in a stock pickers market where fundamentals of a stock have more effect on the price than the overall direction of the market. As a result we observe sudden and large changes in hedge fund positions depending on the news flow. Let’s take a look at the hedge fund sentiment towards Kohl’s Corporation (NYSE:KSS) to find out whether there were any major changes in hedge funds’ views.

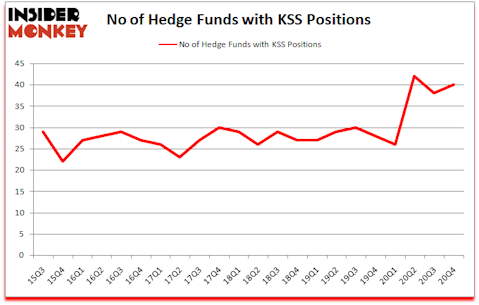

Is KSS stock a buy or sell? Kohl’s Corporation (NYSE:KSS) investors should be aware of an increase in activity from the world’s largest hedge funds lately. Kohl’s Corporation (NYSE:KSS) was in 40 hedge funds’ portfolios at the end of the fourth quarter of 2020. The all time high for this statistic is 42. There were 38 hedge funds in our database with KSS holdings at the end of September. Our calculations also showed that KSS isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

In the financial world there are tons of indicators stock market investors employ to assess their holdings. Two of the most innovative indicators are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the best money managers can trounce the S&P 500 by a healthy margin (see the details here).

Arnaud Ajdler of Engine Capital

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the House passed a landmark bill decriminalizing marijuana. So, we are checking out this under the radar cannabis stock right now. We go through lists like the 10 best battery stocks to buy to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. With all of this in mind we’re going to go over the recent hedge fund action surrounding Kohl’s Corporation (NYSE:KSS).

Do Hedge Funds Think KSS Is A Good Stock To Buy Now?

Heading into the first quarter of 2021, a total of 40 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 5% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards KSS over the last 22 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, holds the largest position in Kohl’s Corporation (NYSE:KSS). Arrowstreet Capital has a $169.8 million position in the stock, comprising 0.2% of its 13F portfolio. Coming in second is Adage Capital Management, managed by Phill Gross and Robert Atchinson, which holds a $164 million position; 0.4% of its 13F portfolio is allocated to the company. Remaining peers that hold long positions comprise Ken Griffin’s Citadel Investment Group, D. E. Shaw’s D E Shaw and John Overdeck and David Siegel’s Two Sigma Advisors. In terms of the portfolio weights assigned to each position Legion Partners Asset Management allocated the biggest weight to Kohl’s Corporation (NYSE:KSS), around 10.34% of its 13F portfolio. Engine Capital is also relatively very bullish on the stock, designating 5.99 percent of its 13F equity portfolio to KSS.

With a general bullishness amongst the heavyweights, some big names have been driving this bullishness. Adage Capital Management, managed by Phill Gross and Robert Atchinson, initiated the biggest position in Kohl’s Corporation (NYSE:KSS). Adage Capital Management had $164 million invested in the company at the end of the quarter. Robert Pohly’s Samlyn Capital also initiated a $89.7 million position during the quarter. The following funds were also among the new KSS investors: David Tepper’s Appaloosa Management LP, Anand Parekh’s Alyeska Investment Group, and Arnaud Ajdler’s Engine Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Kohl’s Corporation (NYSE:KSS) but similarly valued. These stocks are Rexford Industrial Realty Inc (NYSE:REXR), Jabil Inc. (NYSE:JBL), OGE Energy Corp. (NYSE:OGE), Performance Food Group Company (NYSE:PFGC), Penumbra Inc (NYSE:PEN), Stericycle Inc (NASDAQ:SRCL), and Capri Holdings Limited (NYSE:CPRI). All of these stocks’ market caps resemble KSS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| REXR | 17 | 116092 | 5 |

| JBL | 28 | 455207 | -3 |

| OGE | 20 | 180367 | -2 |

| PFGC | 22 | 281693 | -7 |

| PEN | 20 | 280710 | -3 |

| SRCL | 25 | 669567 | 0 |

| CPRI | 42 | 920853 | 6 |

| Average | 24.9 | 414927 | -0.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.9 hedge funds with bullish positions and the average amount invested in these stocks was $415 million. That figure was $1150 million in KSS’s case. Capri Holdings Limited (NYSE:CPRI) is the most popular stock in this table. On the other hand Rexford Industrial Realty Inc (NYSE:REXR) is the least popular one with only 17 bullish hedge fund positions. Kohl’s Corporation (NYSE:KSS) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for KSS is 81.6. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 5.3% in 2021 through March 19th and still beat the market by 0.8 percentage points. Hedge funds were also right about betting on KSS as the stock returned 52.2% since the end of Q4 (through 3/19) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Kohls Corp (NYSE:KSS)

Follow Kohls Corp (NYSE:KSS)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.