Wedgewood Partners recently released its Q3 2020 Investor Letter, a copy of which you can download here. The Fund returned 10.77% for the third quarter of 2020. Meanwhile, the benchmark S&P 500 Index and the Russell 1000 Value Index gained 8.93% and 5.59%, respectively. You should check out Wedgewood Partners’ top 5 stock picks for investors to buy right now, which could be the biggest winners of this year.

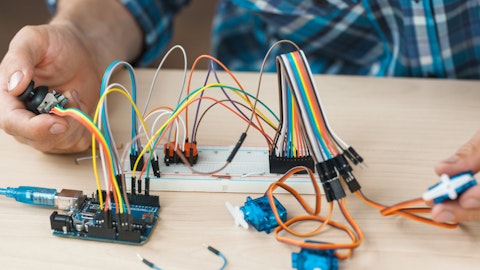

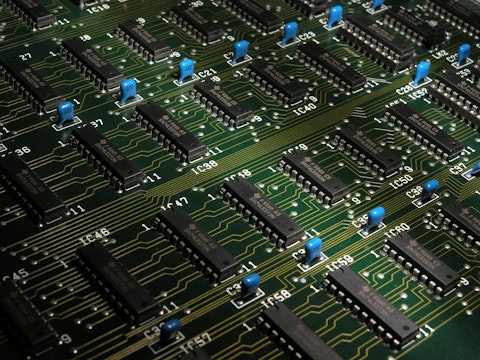

In the said letter, Wedgewood Partners highlighted a few stocks and Keysight Technologies Inc. (NYSE:KEYS) is one of them. Keysight Technologies Inc. (NYSE:KEYS) is an electronics company. Year-to-date, Keysight Technologies Inc. (NYSE:KEYS) stock gained 2.2% and on October 16th it had a closing price of $104.91. Here is what Wedgewood Partners said:

“Continuing with the holdings that contributed the least to our absolute performance, Keysight Technologies reported a slight decline in earnings for the quarter but provided a strong outlook that anticipates a return to double-digit growth next quarter. Even though business activity was disrupted in some of Keysight’s end-markets over the past few months, the Company continues to serve the R&D functions of clients in industries and segments that have very favorable long-term growth characteristics, including electric vehicles, 5G wireless, 400Gb Ethernet, aerospace and defense modernization and semiconductor process development. In addition, we think there remains ample upside to margins as Keysight cross-sells new software solutions to an installed base that has grown dramatically over the past few years. We added to our positions in Keysight during the quarter as the stock remains attractive on an absolute and relative basis.”

In Q2 2020, the number of bullish hedge fund positions on Keysight Technologies Inc. (NYSE:KEYS) stock increased by about 18% from the previous quarter (see the chart here), so a number of other hedge fund managers believe in Keysight Technologies growth potential. Our calculations showed that Keysight Technologies Inc. (NYSE:KEYS) isn’t ranked among the 30 most popular stocks among hedge funds.

The top 10 stocks among hedge funds returned 185% since the end of 2014 and outperformed the S&P 500 Index ETFs by more than 109 percentage points. We know it sounds unbelievable. You have been dismissing our articles about top hedge fund stocks mostly because you were fed biased information by other media outlets about hedge funds’ poor performance. You could have doubled the size of your nest egg by investing in the top hedge fund stocks instead of dumb S&P 500 ETFs. Below you can watch our video about the top 5 hedge fund stocks right now. All of these stocks had positive returns in 2020.

Video: Top 5 Stocks Among Hedge Funds

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost real estate prices. So, we recommended this real estate stock to our monthly premium newsletter subscribers. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free enewsletter below to receive our stories in your inbox:

Disclosure: None. This article is originally published at Insider Monkey.