Hedge funds run by legendary names like Nelson Peltz and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small-caps are where they can generate significant out-performance. These stocks have been on a tear since the end of June, outperforming large-cap index funds by more than 10 percentage points. That’s why we pay special attention to hedge fund activity in these stocks.

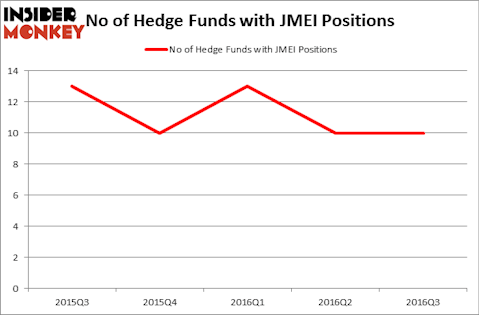

Hedge fund interest in Jumei International Holding Ltd (ADR) (NYSE:JMEI) shares was flat during the third quarter. This is usually a negative indicator. 10 hedge funds that we track owned the stock on September 30, same as on June 30. At the end of this article we will also compare JMEI to other stocks including Eclipse Resources Corp (NYSE:ECR), A. Schulman Inc (NASDAQ:SHLM), and Duluth Holdings Inc (NASDAQ:DLTH) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Africa Studio/Shutterstock.com

How are hedge funds trading Jumei International Holding Ltd (ADR) (NYSE:JMEI)?

At Q3’s end, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, unchanged from the second quarter of 2016. Below, you can check out the change in hedge fund sentiment towards JMEI over the last 5 quarters, which has declined overall. With hedgies’ capital changing hands, there exists a few notable hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Renaissance Technologies, one of the largest hedge funds in the world, has the largest position in Jumei International Holding Ltd (ADR) (NYSE:JMEI), worth close to $11.7 million. The second largest stake is held by Rob Citrone of Discovery Capital Management, which owns a $6.8 million position. Remaining peers with similar optimism consist of Noam Gottesman’s GLG Partners, Chase Coleman’s Tiger Global Management LLC, and John Overdeck and David Siegel’s Two Sigma Advisors. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.