Insider Monkey finished processing more than 700 13F filings made by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of September 30. What do these smart investors think about Harley-Davidson Inc (NYSE:HOG)?

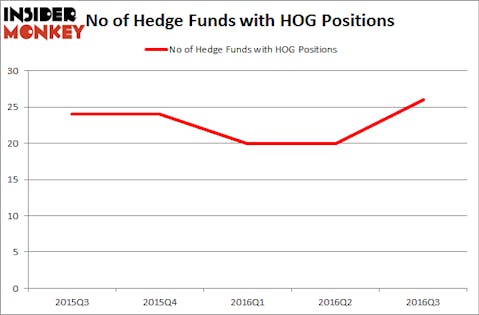

Is Harley-Davidson Inc (NYSE:HOG) an attractive stock to buy now? The smart money is taking an optimistic view. The number of long hedge fund positions increased by 6 lately. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Regency Centers Corp (NYSE:REG), Coca-Cola Enterprises Inc (NYSE:CCE), and Aramark (NYSE:ARMK) to gather more data points.

Follow Harley-Davidson Inc. (NYSE:HOG)

Follow Harley-Davidson Inc. (NYSE:HOG)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Adriano Castelli / Shutterstock.com

What does the smart money think about Harley-Davidson Inc (NYSE:HOG)?

At Q3’s end, a total of 26 of the hedge funds tracked by Insider Monkey were long this stock, a boost of 30% from the second quarter of 2016, resulting in hedge fund ownership of HOG hitting a yearly high. With hedge funds’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Cantillon Capital Management, run by William von Mueffling, holds the most valuable position in Harley-Davidson Inc (NYSE:HOG). The fund reportedly has a $297.2 million position in the stock, comprising 4.2% of its 13F portfolio. Coming in second is Impala Asset Management, led by Robert Bishop, holding a $65.2 million position; the fund has 4.3% of its 13F portfolio invested in the stock. Other members of the smart money that are bullish consist of Daniel Bubis’ Tetrem Capital Management, Matthew Lindenbaum’s Basswood Capital, and Tom Gayner’s Markel Gayner Asset Management.