The Gulf of Mexico shelf oil and gas producer appears to be banging its head on a glass ceiling. The company rapidly caught up with some of the more established peers that share its business model like Stone Energy Corporation (NYSE:SGY) and W&T Offshore, Inc. (NYSE:WTI).

In FY 2009, Energy XXI (NASDAQ:EXXI) produced a mere 7.1 MMBOE (million barrels of oil equivalent). That’s more than doubled to 16.1 MMBOE in FY 2012, on par with both Stone (13 MMBOE in 2011) and W&T (16.9 MMBOE for 2011). Little Energy XXI (Bermuda) Limited (NASDAQ:EXXI) is no longer very little.

The far from new acquire-and-exploit model it employs is simple in concept. It concentrates on proven reserves acquired through leverage. Often these are mature fields in stable decline that still have life, but need some TLC. The emphasis is on producing assets providing predictable cash flow, making arrangement of debt funding possible.

Acquired assets are then milked, with thrown off cash used for capex and debt retirement. When another acquisition comes along, you lever back up and repeat the process. It’s a model that’s worked for years in the Gulf of Mexico for numerous companies.

It’s also a model that requires patience. The right offer needs to come along. And at this point for XXI, it needs to be large enough to move the needle. Like Stone and W&T, Energy XXI (Bermuda) Limited (NASDAQ:EXXI) is getting big enough that it needs a little more than typical table scraps to make an impact. It can be difficult to find deals big enough to sustain growth once you exceed a certain critical mass.

Considering Stone and W&T illustrates the problem. Both companies have found production growth challenging from these levels. Stone’s annual production has weakened slightly since its 2007 peak of 13.6 MMBOE. W&T’s production is actually considerably below its 2007 peak of 21.1 MMBOE. Maintaining these production levels with an acquire-and-exploit strategy is not a trivial feat.

Diversifying operations provides more opportunity for acquisitions

To help find some mojo, W&T and Stone both turned to basins outside the Gulf of Mexico shelf to provide more opportunity. W&T has dabbled in the Deepwater for years and Stone recently increased its Gulf of Mexico Deepwater investment by purchasing BP’s Mississippi Canyon Pompano field. Plans are to increase Deepwater exploration through Joint Ventures (JV) recruited to Stone’s attractive leasehold position.

Onshore’s been a target as well. Stone built a significant Marcellus stake to complement its offshore assets. While its Marcellus stake is not ideal in the current natural gas pricing environment, its West Virginia Marcellus acreage sits in the liquid window and provides value.

W&T moved onshore with its May 2011 acquisition of Yellow Rose Properties, a Permian producer testing Wolfcamp acreage. The Wolfcamp is an active liquids play squarely in the sites of other producers, so there’s some real value here as well. Onshore programs have the added benefit of providing some predictability, since offshore exploration results can be lumpy.

Energy XXI (Bermuda) Limited (NASDAQ:EXXI)’s JV strategy

Like Stone, Energy XXI turned to JVs to find a leg up, partnering with Freeport-McMoRan Copper & Gold Inc.(NYSE:FCX) on its Ultradeep shelf project. That project proved that Wilcox strata that are ridiculously prolific in the Deepwater can be reached on the Shelf, rewriting the geological models of the Gulf floor in the process. However, it’s mired in the tough task of producing these exceptionally high pressure reservoirs. To date, all that the promising project has yielded is potential.

Its more recent JV with Exxon Mobil Corporation (NYSE:XOM) now sits front and center. The multiblock Vermilion deal has a two exploratory well obligation with multiple additional targets. Drilling is underway on the first of two related target reservoirs.

The promise of the Ultradeep raised a great deal of interest in Energy XXI. Because of its own robust growth, the company was perceived to be the safe way to play the Ultradeep in contrast to McMoRan, which is heavily leveraged to the project’s success.

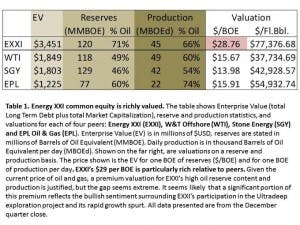

That led to a pretty richly valued company. Comps are unfavorable to its peers on a reserve and production basis (see Table). Some of Energy XXI’s high valuation is warranted given its higher percentage of oil in production and reserves, but the premium to peers is high.

Much of that premium likely results from the Ultradeep. Now that production from these Ultradeep reservoirs is proving elusive, some of that interest is waning and Energy XXI’s growth story becomes that much more important.

It’s not where you’ve been

Where you’re going is even more important. Continuing that growth is Energy XXI’s challenge. The last acquisition was a billion dollar deal. They come along infrequently in the first place. Complicating matters is Energy XXI’s preference to remain geographically compact. That reduces costs and eliminates some geopolitical risk, but deals of this size are not common in the Gulf. And that’s what’s required.

To keep its growth trajectory, Energy XXI’s going to have to spread its wings. There have been hints of a desire to diversify in past presentations, but little has materialized. Hiring Antonio dePinho to oversee JV development suggests a desire for more on the JV end.

Spreading overseas to analogous shallow water basins has also been mentioned, as has a move to Deepwater. Both would be more difficult transitions. On the positive side, geographical diversification would add some operational safety. A severe hurricane is perhaps the biggest risk the company faces, since the company’s assets are so highly concentrated. One big one could conceivably shut-in the bulk of production.

More to the point, widening its hunting grounds may be the only way for Energy XXI to maintain the growth that’s built its rich valuation. For now, all investors have to focus on are the Ultradeep and Vermilion JVs. Pendragon was just above its objective at the end of January. With the recent presentation on Mar. 4, investors are undoubtedly very interested in this important well’s timetable.

The article Is It Time To Get This Gulf Oil Producer Off the Shelf? originally appeared on Fool.com and is written by Peter Horn.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.