Wedgewood Partners, an investment management firm, published its second-quarter 2022 investor letter – a copy of which can be downloaded here. For the first half of 2022, a portfolio net return of -17.2% was recorded by the fund, underperforming the S&P 500 Index which delivered a -16.1% return for the same period. Go over the fund’s top 5 positions to have a glimpse of its finest picks for 2022.

In its Q2 2022 investor letter, Wedgewood Partners mentioned Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) and explained its insights for the company. Founded in 1987, Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) is a Hsinchu, Taiwan-based semiconductor manufacturing company with a $437.8 billion market capitalization. Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) delivered a -29.83% return since the beginning of the year, while its 12-month returns are down by -25.65%. The stock closed at $84.42 per share on July 26, 2022.

Here is what Wedgewood Partners has to say about Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) in its Q2 2022 investor letter:

“Taiwan Semiconductor detracted from performance despite a business performance that saw revenue accelerate to over +30% growth. The Company is one of the few fabs in the world that is capable of manufacturing leading-edge integrated circuits (IC). The Company’s leading-edge capacity is being absorbed by high-performance computing applications, particularly by Apple, which has become an integrated circuit powerhouse over the past decade. The Company’s aggressive investment in leading-edge equipment, tight development with fabless IC designers, and embrace of open development libraries should continue to foster a superior competitive position and attractive long-term growth.”

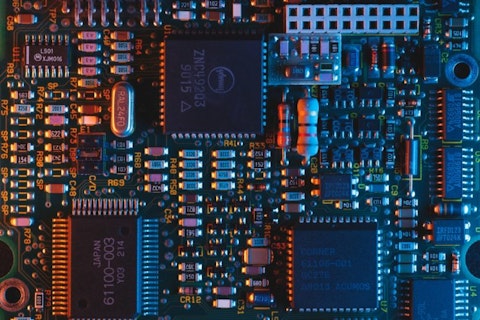

Photo by Umberto on Unsplash

Our calculations show that Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) fell short nd didn’t make it on our list of the 30 Most Popular Stocks Among Hedge Funds. Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) was in 81 hedge fund portfolios at the end of the second quarter of 2022, compared to 72 funds in the previous quarter. Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) delivered a -9.00% return in the past 3 months.

In June 2022, we also shared another hedge fund’s views on Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) in another article. You can find other investor letters from hedge funds and prominent investors on our hedge fund investor letters 2022 Q1 page.

Disclosure: None. This article is originally published at Insider Monkey.