Sound Shore Management, an investment management firm, published its first-quarter 2022 investor letter – a copy of which can be downloaded here. The Sound Shore Fund Investor Class (SSHFX) and Institutional Class (SSHVX) declined 0.97% and 0.91%, respectively, in the first quarter of 2022, trailing the Russell 1000 Value Index (Russell Value) which declined 0.74%. The one-year advances for SSHFX of 10.07% and for SSHVX of 10.30% were behind the Russell Value’s 11.67%. As long-term investors, we highlight that Sound Shore’s 30-year annualized returns of 10.19% and 10.45%, for SSHFX and SSHVX, respectively, as of March 31, 2022, the fund is ahead of the Russell Value at 10.17%. Try to spend some time taking a look at the fund’s top 5 holdings to be informed about their best picks for 2022.

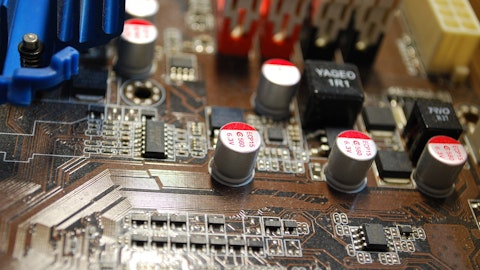

In its Q1 2022 investor letter, Sound Shore Fund mentioned NXP Semiconductors N.V. (NASDAQ:NXPI) and explained its insights for the company. Founded in 2006, NXP Semiconductors N.V. (NASDAQ:NXPI) is an Eindhoven, Netherlands-based semiconductor manufacturing company with a $44.04 billion market capitalization. NXP Semiconductors N.V. (NASDAQ:NXPI) delivered a -26.06% return since the beginning of the year, while its 12-month returns are down by -15.21%. The stock closed at $167.75 per share on April 26, 2022.

Here is what Sound Shore Fund has to say about NXP Semiconductors N.V. (NASDAQ:NXPI) in its Q1 2022 investor letter:

“Similarly, analog chip supplier NXP Semiconductors declined even though the company reported above consensus revenue growth. A leading chip maker for infrastructure and automotive applications, we view NXP as a “new industrial,” uniquely positioned to benefit from increased chip content per application/vehicle. This includes electric and autonomous vehicles and more broadly, connectivity and the internet of things. We added the stock to the portfolio during the volatile fourth quarter of 2018 at just 10 times earnings. Today, NXP is still valued at a very reasonable 14 times earnings.”

jonas-svidras-e28-krnIVmo-unsplash

Our calculations show that NXP Semiconductors N.V. (NASDAQ:NXPI) fell short and didn’t make it on our list of the 30 Most Popular Stocks Among Hedge Funds. NXP Semiconductors N.V. (NASDAQ:NXPI) was in 44 hedge fund portfolios at the end of the fourth quarter of 2021, compared to 51 funds in the previous quarter. NXP Semiconductors N.V. (NASDAQ:NXPI) delivered a -14.49% return in the past 3 months.

In April 2022, we also shared another hedge fund’s views on NXP Semiconductors N.V. (NASDAQ:NXPI) in another article. You can find other investor letters from hedge funds and prominent investors on our hedge fund investor letters 2022 Q1 page.

Disclosure: None. This article is originally published at Insider Monkey.