Carillon Tower Advisers, an investment management firm, published its “Carillon Eagle Small Cap Growth Fund” first quarter 2022 investor letter – a copy of which can be downloaded here. Small-cap stocks overall posted rather lackluster returns in the first quarter of 2022. There was, however, a notable level of disparity between the two style indexes, as the Russell 2000® Growth Index (down 12.63%) significantly lagged its Russell 2000® Value Index (down 2.40%) counterpart for the sixth consecutive quarter. Try to spend some time taking a look at the fund’s top 5 holdings to be informed about their best picks for 2022.

In its Q1 2022 investor letter, Carillon Eagle Small Cap Growth Fund mentioned Trex Company, Inc. (NYSE:TREX) and explained its insights for the company. Founded in 1996, Trex Company, Inc. (NYSE:TREX) is a Winchester, Virginia-based boarding company with a $6.3 billion market capitalization. Trex Company, Inc. (NYSE:TREX) delivered a -58.64% return since the beginning of the year, while its 12-month returns are down by -45.36%. The stock closed at $55.85 per share on June 29, 2022.

Here is what Carillon Eagle Small Cap Growth Fund has to say about Trex Company, Inc. (NYSE:TREX) in its Q1 2022 investor letter:

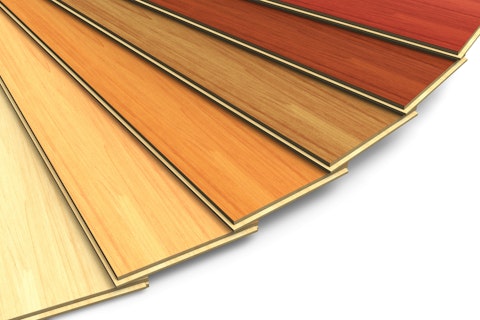

“Trex (NYSE:TREX) manufactures high-performance composite decking and railing products, as well as custom- engineered railing and staging systems, for the commercial and multi-family market. After surging in the prior quarter, the company’s shares declined as rising interest rates weighed a bit on investor sentiment in stocks tied to the housing industry. Despite this, demand for the firm’s products has remained healthy, and we believe Trex should be well positioned to weather any potential downturn in the overall housing industry as its business skews heavily towards repair and remodeling as opposed to new construction.”

Scanrail1/Shutterstock.com

Our calculations show that Trex Company, Inc. (NYSE:TREX) fell short and didn’t make it on our list of the 30 Most Popular Stocks Among Hedge Funds. Trex Company, Inc. (NYSE:TREX) was in 38 hedge fund portfolios at the end of the first quarter of 2022, compared to 28 funds in the previous quarter. Trex Company, Inc. (NYSE:TREX) delivered a -20.80% return in the past 3 months.

In June 2022, we also shared another hedge fund’s views on Trex Company, Inc. (NYSE:TREX) in another article. You can find other investor letters from hedge funds and prominent investors on our hedge fund investor letters 2022 Q1 page.

Disclosure: None. This article is originally published at Insider Monkey.