Artisan Partners, an investment management company, released its “Artisan Small Cap Fund” third quarter 2022 investor letter. A copy of the same can be downloaded here. In the third quarter, its Investor Class fund ARTSX returned 3.23%, Advisor Class fund APDSX posted a return of 3.27%, and Institutional Class fund APHSX returned 3.27%, compared to a return of 0.24% for the Russell 2000 Growth Index. In addition, please check the fund’s top five holdings to know its best picks in 2022.

In the third-quarter letter, Artisan Partners discussed stocks like Monolithic Power Systems, Inc. (NASDAQ:MPWR). Headquartered in Kirkland, Washington, Monolithic Power Systems, Inc. (NASDAQ:MPWR) engages in the business of semiconductor-based power electronics solutions. On November 11, 2022, Monolithic Power Systems, Inc. (NASDAQ:MPWR) stock closed at $393.37 per share. One-month return of Monolithic Power Systems, Inc. (NASDAQ:MPWR) was 24.42% and its shares lost 30.12% of their value over the last 52 weeks. Monolithic Power Systems, Inc. (NASDAQ:MPWR) has a market capitalization of $18.466 billion.

Artisan Partners made the following comment about Monolithic Power Systems, Inc. (NASDAQ:MPWR) in its Q3 2022 investor letter:

“We pared our exposures to Monolithic Power Systems, Inc. (NASDAQ:MPWR) and Novanta. Monolithic Power designs analog power-management chips for a wide variety of industrial and consumer devices. The company is executing well as its customers convert their analog, digital and power semiconductor chips into its single-chip design, which is energy efficient and priced lower than peers. Based on its unique ability to offer highly integrated solutions and solve complex power management issues across multiple end-applications, we believe the profit cycle runway ahead is meaningful. However, the company’s market cap has grown above our small-cap mandate, and we started harvesting our position during the quarter. This caps a successful investment campaign which began in 2018.”

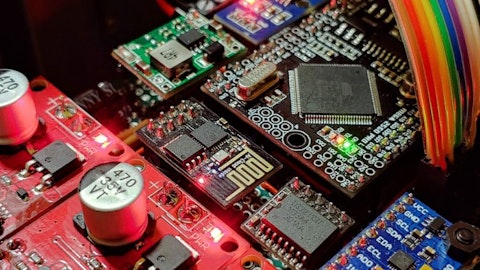

electronics-6055226_1280

Monolithic Power Systems, Inc. (NASDAQ:MPWR) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 36 hedge fund portfolios held Monolithic Power Systems, Inc. (NASDAQ:MPWR) at the end of the second quarter which was 29 in the previous quarter.

We discussed Monolithic Power Systems, Inc. (NASDAQ:MPWR) in another article and shared the stock picks of John Hurley’s Cavalry Asset Management. In addition, please check out our hedge fund investor letters Q3 2022 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 15 Fastest Growing Economies in the World

- 10 Best Stock Market Sleeper Stocks to Buy

- 10 Best Railroad Stocks To Buy

Disclosure: None. This article is originally published at Insider Monkey.