A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on Isle of Capri Casinos (NASDAQ:ISLE).

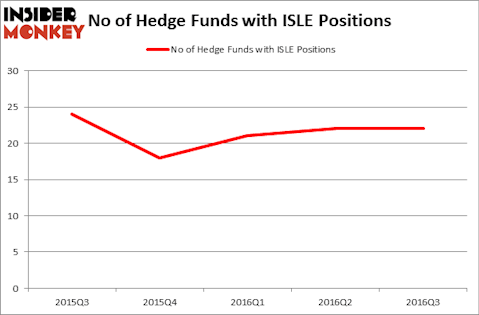

Hedge fund interest in Isle of Capri Casinos (NASDAQ:ISLE) shares was flat during the last quarter. This is usually a negative indicator. 22 hedge funds that we track owned the stock on September 30, same as on June 30. At the end of this article we will also compare ISLE to other stocks including Alamo Group, Inc. (NYSE:ALG), CenterState Banks Inc (NASDAQ:CSFL), and Hersha Hospitality Trust (NYSE:HT) to get a better sense of its popularity.

Follow Isle Of Capri Casinos Inc (NASDAQ:ISLE)

Follow Isle Of Capri Casinos Inc (NASDAQ:ISLE)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

infocus/shutterstock.com

How are hedge funds trading Isle of Capri Casinos (NASDAQ:ISLE)?

Heading into the fourth quarter of 2016, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, unchanged from the previous quarter. After some volatility at the beginning of the year, trading in the company’s shares by hedge funds has been stable. With the smart money’s sentiment swirling, there exists a few noteworthy hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, PAR Capital Management, managed by Paul Reeder and Edward Shapiro, holds the biggest position in Isle of Capri Casinos (NASDAQ:ISLE). PAR Capital Management has an $83.4 million position in the stock, comprising 1.2% of its 13F portfolio. The second largest stake is held by Jim Simons of Renaissance Technologies, with a $40.1 million position. Some other peers with similar optimism encompass Alec Litowitz and Ross Laser’s Magnetar Capital, Matthew Halbower’s Pentwater Capital Management and Bryant Regan’s Lafitte Capital Management.

Due to the fact that Isle of Capri Casinos (NASDAQ:ISLE) has witnessed flat interest from the aggregate hedge fund industry, it’s easy to see that there were a few money managers that decided to sell off their entire stakes last quarter. It’s worth mentioning that Don Morgan’s Brigade Capital sold off the biggest investment of the 700 funds followed by Insider Monkey, worth close to $9.2 million in stock, and Buckley Ratchford’s Wingspan Investment Management was right behind this move, as the fund sold off about $3.6 million worth of shares. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Isle of Capri Casinos (NASDAQ:ISLE) but similarly valued. We will take a look at Alamo Group, Inc. (NYSE:ALG), CenterState Banks Inc (NASDAQ:CSFL), Hersha Hospitality Trust (NYSE:HT), and Dominion Diamond Corp (NYSE:DDC). This group of stocks’ market valuations are similar to ISLE’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ALG | 10 | 148174 | -2 |

| CSFL | 18 | 56172 | 5 |

| HT | 10 | 41390 | 2 |

| DDC | 14 | 73277 | 0 |

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $80 million. That figure was $220 million in ISLE’s case. CenterState Banks Inc (NASDAQ:CSFL) is the most popular stock in this table. On the other hand Alamo Group, Inc. (NYSE:ALG) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Isle of Capri Casinos (NASDAQ:ISLE) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None