Hedge fund managers like David Einhorn, Dan Loeb, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: InVitae Corp (NYSE:NVTA) .

InVitae Corp (NYSE:NVTA) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 8 hedge funds’ portfolios at the end of the third quarter of 2016. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as First Connecticut Bancorp Inc (NASDAQ:FBNK), Gafisa SA (ADR) (NYSE:GFA), and Silicon Graphics International Corp (NASDAQ:SGI) to gather more data points.

Follow Invitae Corp (NYSE:NVTA)

Follow Invitae Corp (NYSE:NVTA)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Yang Nan/Shutterstock.com

Now, we’re going to take a gander at the key action surrounding InVitae Corp (NYSE:NVTA).

What have hedge funds been doing with InVitae Corp (NYSE:NVTA)?

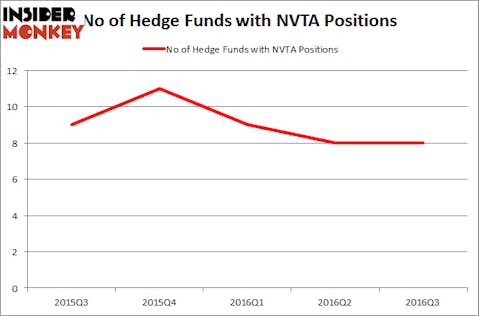

At Q3’s end, a total of 8 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. The graph below displays the number of hedge funds with bullish position in NVTA over the last 5 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Julian Baker and Felix Baker’s Baker Bros. Advisors has the biggest position in InVitae Corp (NYSE:NVTA), worth close to $57.4 million, amounting to 0.5% of its total 13F portfolio. The second most bullish fund manager is Camber Capital Management, led by Stephen DuBois, holding a $21.4 million position; the fund has 0.9% of its 13F portfolio invested in the stock. Other peers that hold long positions include Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management, Jeremy Green’s Redmile Group and Samuel Isaly’s OrbiMed Advisors. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the third quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as InVitae Corp (NYSE:NVTA) but similarly valued. These stocks are First Connecticut Bancorp Inc (NASDAQ:FBNK), Gafisa SA (ADR) (NYSE:GFA), Silicon Graphics International Corp (NASDAQ:SGI), and LSI Industries, Inc. (NASDAQ:LYTS). All of these stocks’ market caps match NVTA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FBNK | 7 | 24519 | -5 |

| GFA | 3 | 2709 | 0 |

| SGI | 16 | 64365 | 7 |

| LYTS | 12 | 35199 | 1 |

As you can see these stocks had an average of 9.5 hedge funds with bullish positions and the average amount invested in these stocks was $32 million. That figure was $99 million in NVTA’s case. Silicon Graphics International Corp (NASDAQ:SGI) is the most popular stock in this table. On the other hand Gafisa SA (ADR) (NYSE:GFA) is the least popular one with only 3 bullish hedge fund positions. InVitae Corp (NYSE:NVTA) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SGI might be a better candidate to consider taking a long position in.

Disclosure: None