With the third-quarter round of 13F filings behind us it is time to take a look at the stocks in which some of the best money managers in the world preferred to invest or sell heading into the fourth quarter. One of these stocks was IntriCon Corporation (NASDAQ:IIN).

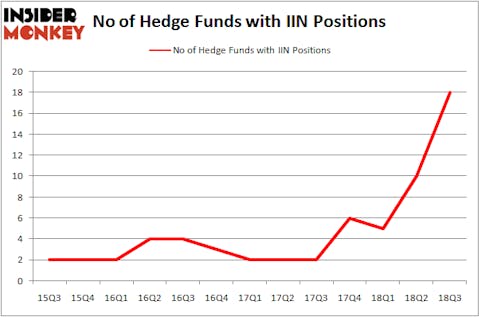

Is IntriCon Corporation (NASDAQ:IIN) the right investment to pursue these days? Prominent investors are getting more optimistic. The number of long hedge fund bets went up by 8 in recent months. Our calculations also showed that IIN isn’t among the 30 most popular stocks among hedge funds. IIN was in 18 hedge funds’ portfolios at the end of the third quarter of 2018. There were 10 hedge funds in our database with IIN holdings at the end of the previous quarter.

In the financial world there are a multitude of gauges stock traders can use to grade publicly traded companies. Some of the best gauges are hedge fund and insider trading indicators. We have shown that, historically, those who follow the best picks of the top hedge fund managers can trounce the market by a superb margin (see the details here).

Let’s take a peek at the latest hedge fund action surrounding IntriCon Corporation (NASDAQ:IIN).

How have hedgies been trading IntriCon Corporation (NASDAQ:IIN)?

Heading into the fourth quarter of 2018, a total of 18 of the hedge funds tracked by Insider Monkey were long this stock, a change of 80% from the previous quarter. The graph below displays the number of hedge funds with bullish position in IIN over the last 13 quarters. With the smart money’s sentiment swirling, there exists a select group of key hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

More specifically, Citadel Investment Group was the largest shareholder of IntriCon Corporation (NASDAQ:IIN), with a stake worth $16.7 million reported as of the end of September. Trailing Citadel Investment Group was Alyeska Investment Group, which amassed a stake valued at $14.6 million. Renaissance Technologies, Driehaus Capital, and Redmile Group were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, key hedge funds were leading the bulls’ herd. Citadel Investment Group, managed by Ken Griffin, established the largest position in IntriCon Corporation (NASDAQ:IIN). Citadel Investment Group had $16.7 million invested in the company at the end of the quarter. Anand Parekh’s Alyeska Investment Group also made a $14.6 million investment in the stock during the quarter. The following funds were also among the new IIN investors: Jeremy Green’s Redmile Group, Principal Global Investors’s Columbus Circle Investors, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as IntriCon Corporation (NASDAQ:IIN) but similarly valued. These stocks are Intrepid Potash, Inc. (NYSE:IPI), Hingham Institution for Savings (NASDAQ:HIFS), Morgan Stanley China A Share Fund Inc. (NYSE:CAF), and Gilat Satellite Networks Ltd. (NASDAQ:GILT). This group of stocks’ market values resemble IIN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IPI | 14 | 30661 | 0 |

| HIFS | 1 | 5012 | 0 |

| CAF | 2 | 2950 | -2 |

| GILT | 2 | 26799 | 0 |

| Average | 4.75 | 16356 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 4.75 hedge funds with bullish positions and the average amount invested in these stocks was $16 million. That figure was $77 million in IIN’s case. Intrepid Potash, Inc. (NYSE:IPI) is the most popular stock in this table. On the other hand Hingham Institution for Savings (NASDAQ:HIFS) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks IntriCon Corporation (NASDAQ:IIN) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.