Billionaire hedge fund managers such as Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

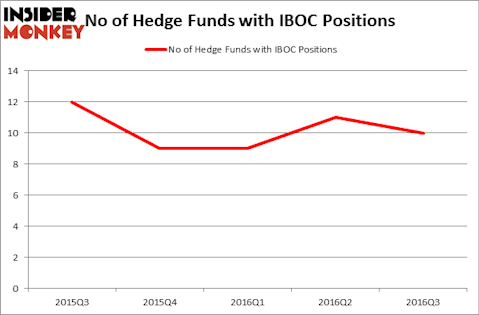

International Bancshares Corp (NASDAQ:IBOC) investors should be aware of a decrease in enthusiasm from smart money in recent months. IBOC was in 10 hedge funds’ portfolios at the end of the third quarter of 2016. There were 11 hedge funds in our database with IBOC holdings at the end of the previous quarter. At the end of this article we will also compare IBOC to other stocks including SolarCity Corp (NASDAQ:SCTY), Cohen & Steers, Inc. (NYSE:CNS), and Surgical Care Affiliates Inc (NASDAQ:SCAI) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Kevin George/Shutterstock.com

With all of this in mind, let’s check out the latest action regarding International Bancshares Corp (NASDAQ:IBOC).

How are hedge funds trading International Bancshares Corp (NASDAQ:IBOC)?

At the end of the third quarter, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of -9% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in IBOC over the last 5 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Bernard Horn’s Polaris Capital Management has the number one position in International Bancshares Corp (NASDAQ:IBOC), worth close to $19.7 million, comprising 1.5% of its total 13F portfolio. The second most bullish fund manager is Peter Rathjens, Bruce Clarke and John Campbell of Arrowstreet Capital holding a $5.7 million position. Remaining peers that are bullish include Jim Simons’ Renaissance Technologies which is one of the largest hedge funds in the world, Cliff Asness’ AQR Capital Management and Roger Ibbotson’s Zebra Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Since International Bancshares Corp (NASDAQ:IBOC) has weathered falling interest from the entirety of the hedge funds we track, it’s safe to say that there lies a certain “tier” of funds that elected to cut their full holdings heading into Q4. At the top of the heap, Israel Englander’s Millennium Management dropped the biggest position of the around 700 funds tracked by Insider Monkey, worth an estimated $0.7 million in stock, and Matthew Tewksbury’s Stevens Capital Management was right behind this move, as the fund said goodbye to about $0.3 million worth of shares.

Let’s go over hedge fund activity in other stocks similar to International Bancshares Corp (NASDAQ:IBOC). These stocks are SolarCity Corp (NASDAQ:SCTY), Cohen & Steers, Inc. (NYSE:CNS), Surgical Care Affiliates Inc (NASDAQ:SCAI), and MGE Energy, Inc. (NASDAQ:MGEE). This group of stocks’ market values match IBOC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SCTY | 19 | 82586 | -7 |

| CNS | 9 | 104415 | 1 |

| SCAI | 16 | 82664 | 4 |

| MGEE | 9 | 17440 | -2 |

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $72 million. That figure was $38 million in IBOC’s case. SolarCity Corp (NASDAQ:SCTY) is the most popular stock in this table. On the other hand Cohen & Steers, Inc. (NYSE:CNS) is the least popular one with only 9 bullish hedge fund positions. International Bancshares Corp (NASDAQ:IBOC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SCTY might be a better candidate to consider taking a long position in.

Disclosure: None