Out of thousands of stocks that are currently traded on the market, it is difficult to determine those that can really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of over 700 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about InflaRx N.V. (NASDAQ:IFRX).

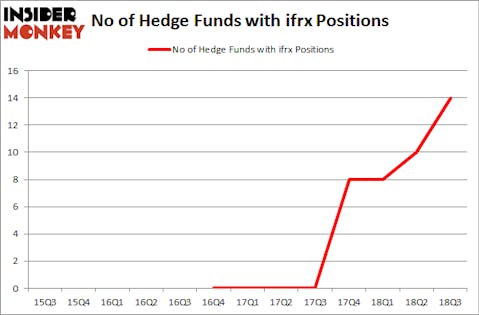

InflaRx N.V. (NASDAQ:IFRX) has seen an increase in enthusiasm from smart money recently. IFRX was in 14 hedge funds’ portfolios at the end of September. There were 10 hedge funds in our database with IFRX holdings at the end of the previous quarter. Our calculations also showed that ifrx isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a peek at the key hedge fund action regarding InflaRx N.V. (NASDAQ:IFRX).

How have hedgies been trading InflaRx N.V. (NASDAQ:IFRX)?

At the end of the third quarter, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a change of 40% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards IFRX over the last 13 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

The largest stake in InflaRx N.V. (NASDAQ:IFRX) was held by Adage Capital Management, which reported holding $87.6 million worth of stock at the end of September. It was followed by Redmile Group with a $69.5 million position. Other investors bullish on the company included RA Capital Management, Cormorant Asset Management, and Scopia Capital.

As industrywide interest jumped, some big names were leading the bulls’ herd. Scopia Capital, managed by Matt Sirovich and Jeremy Mindich, assembled the most valuable position in InflaRx N.V. (NASDAQ:IFRX). Scopia Capital had $7 million invested in the company at the end of the quarter. Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management also initiated a $6.1 million position during the quarter. The following funds were also among the new IFRX investors: Brian Ashford-Russell and Tim Woolley’s Polar Capital and Jim Simons’s Renaissance Technologies.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as InflaRx N.V. (NASDAQ:IFRX) but similarly valued. These stocks are Origin Bancorp, Inc. (NASDAQ:OBNK), Echo Global Logistics, Inc. (NASDAQ:ECHO), American Railcar Industries, Inc. (NASDAQ:ARII), and Comstock Resources Inc (NYSE:CRK). This group of stocks’ market values are closest to IFRX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OBNK | 6 | 23723 | 1 |

| ECHO | 14 | 43416 | -4 |

| ARII | 13 | 567890 | 1 |

| CRK | 5 | 7315 | -2 |

| Average | 9.5 | 160586 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.5 hedge funds with bullish positions and the average amount invested in these stocks was $161 million. That figure was $300 million in IFRX’s case. Echo Global Logistics, Inc. (NASDAQ:ECHO) is the most popular stock in this table. On the other hand Comstock Resources Inc (NYSE:CRK) is the least popular one with only 5 bullish hedge fund positions. InflaRx N.V. (NASDAQ:IFRX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ECHO might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.