Hedge funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of September. At Insider Monkey, we follow over 700 of the best-performing investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is ICON PLC (NASDAQ:ICLR), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

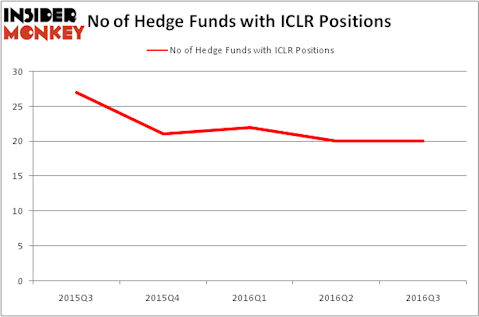

Hedge fund interest in ICON PLC (NASDAQ:ICLR) shares was flat at the end of last quarter, with 20 hedge funds bullish on the company. At the end of this article we will also compare ICLR to other stocks including Euronet Worldwide, Inc. (NASDAQ:EEFT), Patheon NV (NYSE:PTHN), and AmeriGas Partners, L.P. (NYSE:APU) to get a better sense of its popularity.

Follow Icon Plc (NASDAQ:ICLR)

Follow Icon Plc (NASDAQ:ICLR)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

everything possible/Shutterstock.com

What does the smart money think about ICON PLC (NASDAQ:ICLR)?

Heading into the fourth quarter of 2016, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, unchanged from the previous quarter. Below, you can check out the change in hedge fund sentiment towards ICLR over the last 5 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Millennium Management, one of the 10 largest hedge funds in the world has the most valuable position in ICON PLC (NASDAQ:ICLR), worth close to $91.7 million. On Millennium Management’s heels is Polar Capital, led by Brian Ashford-Russell and Tim Woolley, which holds a $48 million position. Remaining peers with similar optimism encompass Anand Parekh’s Alyeska Investment Group, Jim Simons’ Renaissance Technologies and Christopher James’ Partner Fund Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Due to the fact that ICON PLC (NASDAQ:ICLR) has encountered bearish sentiment from the entirety of the hedge funds we track, we can see that there exists a select few money managers that elected to cut their full holdings by the end of the third quarter. Interestingly, Arthur B Cohen and Joseph Healey’s Healthcor Management LP cashed in the biggest investment of the “upper crust” of funds studied by Insider Monkey, valued at an estimated $33.3 million in stock. Ken Griffin’s fund, Citadel Investment Group, also cut its stock, about $7.4 million worth.

Let’s also examine hedge fund activity in other stocks similar to ICON PLC (NASDAQ:ICLR). These stocks are Euronet Worldwide, Inc. (NASDAQ:EEFT), Patheon NV (NYSE:PTHN), AmeriGas Partners, L.P. (NYSE:APU), and FNFV Group (NYSE:FNFV). All of these stocks’ market caps resemble ICLR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EEFT | 22 | 233336 | -6 |

| PTHN | 21 | 177484 | 21 |

| APU | 8 | 5691 | 3 |

| FNFV | 19 | 205511 | -1 |

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $156 million. That figure was $282 million in ICLR’s case. Euronet Worldwide, Inc. (NASDAQ:EEFT) is the most popular stock in this table. On the other hand AmeriGas Partners, L.P. (NYSE:APU) is the least popular one with only 8 bullish hedge fund positions. ICON PLC (NASDAQ:ICLR) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard EEFT might be a better candidate to consider taking a long position in.

Disclosure: None