The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Hostess Brands Inc (NASDAQ:GRSH).

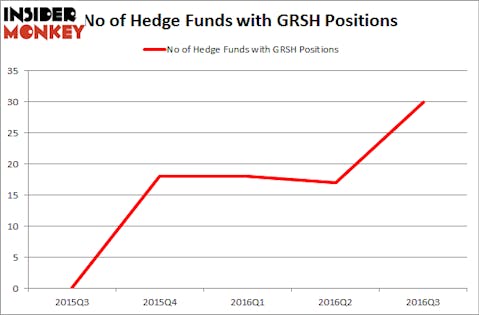

Hostess Brands Inc (NASDAQ:GRSH) shareholders witnessed an increase in hedge fund sentiment last quarter. There were 30 hedge funds in our database with GRSH positions at the end of the previous quarter. At the end of this article we will also compare GRSH to other stocks including Changyou.Com Ltd (ADR) (NASDAQ:CYOU), Capital Senior Living Corporation (NYSE:CSU), and Tejon Ranch Company (NYSE:TRC) to get a better sense of its popularity.

Follow Hostess Brands Inc. (NASDAQ:TWNK)

Follow Hostess Brands Inc. (NASDAQ:TWNK)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Kritchanut/Shutterstock.com

Keeping this in mind, we’re going to check out the new action encompassing Hostess Brands Inc (NASDAQ:GRSH).

What does the smart money think about Hostess Brands Inc (NASDAQ:GRSH)?

Heading into the fourth quarter of 2016, a total of 30 funds tracked by Insider Monkey were bullish on this stock, up by 76% from one quarter earlier. By comparison, 18 hedge funds held shares or bullish call options in GRSH heading into 2016. With hedgies’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Alan Fournier’s Pennant Capital Management holds the largest position in Hostess Brands Inc (NASDAQ:GRSH). Pennant Capital Management has a $22.9 million position in the stock, comprising 0.8% of its 13F portfolio. On Pennant Capital Management’s heels is BeaconLight Capital, led by Ed Bosek, holding a $18.6 million position; the fund has 6.7% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that are bullish include Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, and Stephen Loukas, David A. Lorber, Zachary George’s FrontFour Capital Group. These funds initiated stakes in GRSH during the third quarter. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

On the next page, we’ll compare Hostess Brands with other stocks in the same market-cap value range.