Is Hospitality Properties Trust (NYSE:HPT) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to find the latest market-moving information.

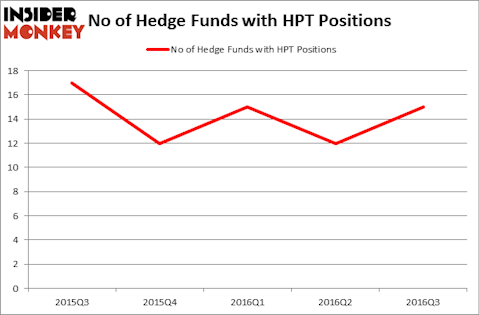

Hospitality Properties Trust (NYSE:HPT) investors should pay attention to an increase in support from the world’s most successful money managers of late. HPT was in 15 hedge funds’ portfolios at the end of September. There were 12 hedge funds in our database with HPT positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Healthcare Trust Of America Inc (NYSE:HTA), Cognex Corporation (NASDAQ:CGNX), and Taubman Centers, Inc. (NYSE:TCO) to gather more data points.

Follow Service Properties Trust (NASDAQ:NASDAQ:SVC)

Follow Service Properties Trust (NASDAQ:NASDAQ:SVC)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Mikko Lemola/Shutterstock.com

How have hedgies been trading Hospitality Properties Trust (NYSE:HPT)?

At the end of the third quarter, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a 25% rise from the second quarter of 2016. The graph below displays the number of hedge funds with bullish positions in HPT over the last 5 quarters, which has alternated between declines and rises, and hedgies trade in and out of the stock. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Richard S. Pzena’s Pzena Investment Management has the largest position in Hospitality Properties Trust (NYSE:HPT), worth close to $17.5 million. The second largest stake is held by Anand Parekh’s Alyeska Investment Group, which holds a $13.2 million position. Remaining peers that hold long positions comprise Greg Poole’s Echo Street Capital Management, Ken Griffin’s Citadel Investment Group, and Matthew Hulsizer’s PEAK6 Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.