It seems that the masses and most of the financial media hate hedge funds and what they do, but why is this hatred of hedge funds so prominent? At the end of the day, these asset management firms do not gamble the hard-earned money of the people who are on the edge of poverty. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. The Standard and Poor’s 500 Index returned approximately 5.7% in the 12 months ending October 26 (including dividend payments). Conversely, hedge funds’ 30 preferred S&P 500 stocks (as of June 2018) generated a return of 15.1% during the same 12-month period, with 53% of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like First Financial Bankshares Inc (NASDAQ:FFIN).

Hedge fund interest in First Financial Bankshares Inc (NASDAQ:FFIN) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare FFIN to other stocks including Axon Enterprise, Inc. (NASDAQ:AAXN), Kirkland Lake Gold Ltd. (NYSE:KL), and Spectrum Brands Holdings, Inc. (NYSE:SPB) to get a better sense of its popularity.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s check out the recent hedge fund action encompassing First Financial Bankshares Inc (NASDAQ:FFIN).

Hedge fund activity in First Financial Bankshares Inc (NASDAQ:FFIN)

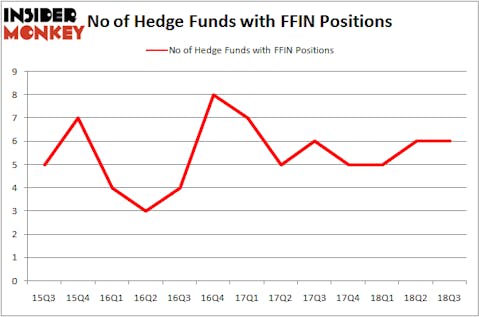

At Q3’s end, a total of 6 of the hedge funds tracked by Insider Monkey were bullish on this stock, no change from the second quarter of 2018. On the other hand, there were a total of 5 hedge funds with a bullish position in FFIN at the beginning of this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Dmitry Balyasny’s Balyasny Asset Management has the biggest position in First Financial Bankshares Inc (NASDAQ:FFIN), worth close to $6.4 million, amounting to less than 0.1%% of its total 13F portfolio. The second most bullish fund manager is PEAK6 Capital Management, led by Matthew Hulsizer, holding a $3.1 million call position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other peers that are bullish include Ken Griffin’s Citadel Investment Group, Noam Gottesman’s GLG Partners and Israel Englander’s Millennium Management.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Laurion Capital Management. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Millennium Management).

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as First Financial Bankshares Inc (NASDAQ:FFIN) but similarly valued. These stocks are Axon Enterprise, Inc. (NASDAQ:AAXN), Kirkland Lake Gold Ltd. (NYSE:KL), Spectrum Brands Holdings, Inc. (NYSE:SPB), and TCF Financial Corporation (NYSE:TCF). All of these stocks’ market caps are similar to FFIN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AAXN | 16 | 439775 | -12 |

| KL | 20 | 170961 | 5 |

| SPB | 26 | 915142 | 4 |

| TCF | 24 | 308162 | 9 |

| Average | 21.5 | 458510 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.5 hedge funds with bullish positions and the average amount invested in these stocks was $459 million. That figure was $10 million in FFIN’s case. Spectrum Brands Holdings, Inc. (NYSE:SPB) is the most popular stock in this table. On the other hand Axon Enterprise, Inc. (NASDAQ:AAXN) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks First Financial Bankshares Inc (NASDAQ:FFIN) is even less popular than AAXN. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.