Some technology companies have quite an innovative business strategy for making money. In this new era of diverse hardware options paired with free or at the least very cheap software, many tech companies have forgone the traditional software model for something different. Instead of users being the customer, the actual revenue often comes from advertisers.

The genesis

We all know the story about how Google Inc (NASDAQ:GOOG)developed its product, search, and then figured out a way to make money off of it. But no one realized just what a hit advertising would be: in 2004, when Google Inc (NASDAQ:GOOG) first became a public company, revenue hit $3 billion. Last year, Google had revenue of over $50 billion.

From 2012. Source: ABCNews

Most of that money comes from ads. It comes from using targeted data with keywords people are searching for and serving up what they want. The best part? Public perception places Google Inc (NASDAQ:GOOG) in high regard. This can be linked to the fact people use Google for something. They realize that the company needs to make money in return for using their services. It’s an exchange that users are more than willing to make with Google.

The user angle with Facebook Inc (NASDAQ:FB)

Facebook Inc (NASDAQ:FB) has had a similar strategy as Google Inc (NASDAQ:GOOG), and this is why people draw comparisons to the two companies. The plan for Facebook from the start was to obtain users, then figure out how to monetize them. And as Facebook Inc (NASDAQ:FB) surpassed 1 billion active users, the company’s revenue has increased: from 2011 to 2012, revenue was up 37% to $5.7 billion.

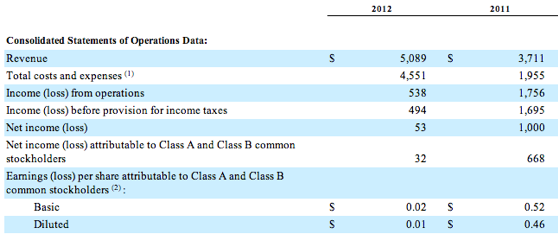

Facebook operations data. Source: Facebook 10-K

Facebook was also profitable in 2012, making a $53 million profit. But, that’s a far cry from the $1 billion profit it made on $3.7 billion in 2011. For the first quarter, income was up slightly, 6% year over year. And the company is making heavy investments in infrastructure. The past two quarters have seen Facebook Inc (NASDAQ:FB) spend a combined $3.9 billion in networking equipment alone.

Making bets

That’s hefty capital spending at a time that Facebook has been criticized recently for poor performance. But investing in all that hardware means that the company continues to believe that it will experience a high degree of growth. Growth in user activity is good for Facebook. But the only question is whether or not Facebook Inc (NASDAQ:FB) can properly monetize its user base’s activities.

Source: Business Insider

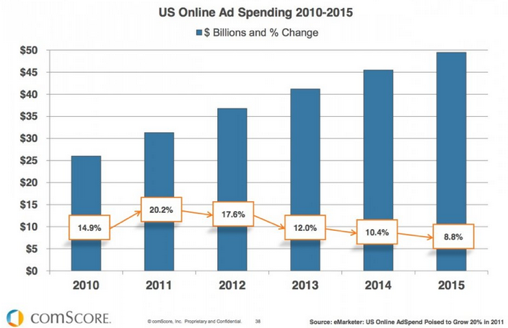

Facebook Inc (NASDAQ:FB)’s not monetizing the way Google Inc (NASDAQ:GOOG) does, at least not under its existing business model. Instead of users voluntarily providing like in a Google search, Facebook leverages the user data that is shared on its platform in order to target advertising and other services to them. Online ad spending is expected to top $40 billion in 2013, so it is trying this within the reality of a growing market.