Like everyone else, elite investors make mistakes. Some of their top consensus picks, such as Valeant and SunEdison, have not done well during the last 12 months due to various reasons. Nevertheless, the data show elite investors’ consensus picks have done well on average. The top 30 mid-cap stocks (market caps between $1 billion and $10 billion) among hedge funds delivered an average return of 18% during the last four quarters. S&P 500 Index returned only 7.6% during the same period and less than 49% of its constituents managed to beat this return. Because their consensus picks have done well, we pay attention to what elite funds and billionaire investors think before doing extensive research on a stock.

In this article, we take a closer look at Facebook Inc (NASDAQ:FB) from the perspective of those elite funds. Moreover, at the end of this article we will also compare FB to other stocks including General Electric Company (NYSE:GE), AT&T Inc. (NYSE:T), and Wells Fargo & Co (NYSE:WFC) to get a better sense of its popularity.

Follow Meta Platforms Inc. (NASDAQ:META)

Follow Meta Platforms Inc. (NASDAQ:META)

Receive real-time insider trading and news alerts

According to most market participants, hedge funds are perceived as unimportant, outdated financial vehicles of yesteryear. While there are more than 8000 funds in operation today, We hone in on the leaders of this group, about 700 funds. These hedge fund managers control the lion’s share of the hedge fund industry’s total asset base, and by paying attention to their highest performing investments, Insider Monkey has spotted many investment strategies that have historically beaten the broader indices. Insider Monkey’s small-cap hedge fund strategy exceeded the S&P 500 index by 12 percentage points per year for a decade in their back tests.

With all of this in mind, let’s check out the new action encompassing Facebook Inc (NASDAQ:FB).

Hedge fund activity in Facebook Inc (NASDAQ:FB)

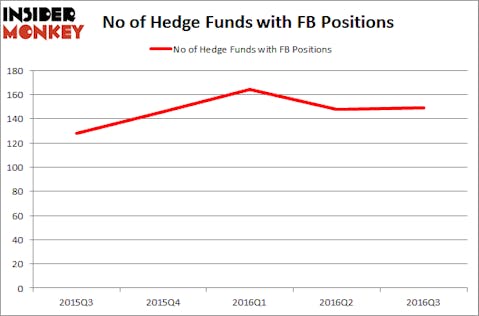

Heading into the fourth quarter of 2016, 149 of the funds tracked by Insider Monkey were long this stock, up by one fund over the quarter. With the smart money’s capital changing hands, there exists a few notable hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Viking Global, managed by Andreas Halvorsen, holds the number one position in Facebook Inc (NASDAQ:FB). Viking Global has a $2.405 billion position in the stock, comprising 10.4% of its 13F portfolio. The second largest stake is held by Arrowstreet Capital, led by Peter Rathjens, Bruce Clarke and John Campbell, holding a $912.4 million position; the fund has 3% of its 13F portfolio invested in the stock. Remaining professional money managers that are bullish encompass Philippe Laffont’s Coatue Management, Stephen Mandel’s Lone Pine Capital and Dan Loeb’s Third Point.

As industrywide interest jumped, some big names were breaking ground themselves. Citadel Investment Group, managed by Ken Griffin, initiated the largest call position in Facebook Inc (NASDAQ:FB). Citadel Investment Group had $455.7 million invested in the company at the end of the quarter. Matthew Knauer and Mina Faltas’s Nokota Management also made a $224.5 million investment in the stock during the quarter. The other funds with brand new FB positions are David Tepper’s Appaloosa Management LP, Gabriel Plotkin’s Melvin Capital Management, and Yen Liow’s Aravt Global.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Facebook Inc (NASDAQ:FB) but similarly valued. We will take a look at General Electric Company (NYSE:GE), AT&T Inc. (NYSE:T), Wells Fargo & Co (NYSE:WFC), and China Mobile Ltd. (ADR) (NYSE:CHL). This group of stocks’ market values match FB’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GE | 55 | 5080463 | -2 |

| T | 51 | 2546244 | -4 |

| WFC | 104 | 27422982 | 16 |

| CHL | 20 | 328304 | -3 |

As you can see these stocks had an average of 58 hedge funds with bullish positions at the end of September and the average amount invested in these stocks was $8.84 billion. On the other hand, the total value of hedge funds’ holdings in Facebook is much higher – $16.28 billion. Wells Fargo & Co (NYSE:WFC) is the most popular stock in this table. On the other hand China Mobile Ltd. (ADR) (NYSE:CHL) is the least popular one with only 20 bullish hedge fund positions. Compared to these stocks Facebook Inc (NASDAQ:FB) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.