Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we follow the hedge fund activity in the small-cap space.

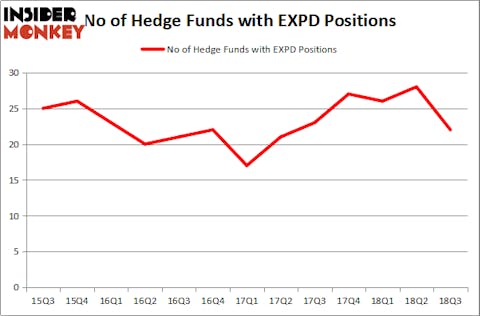

Expeditors International of Washington, Inc. (NASDAQ:EXPD) was in 22 hedge funds’ portfolios at the end of September. EXPD has experienced a decrease in support from the world’s most elite money managers lately. There were 28 hedge funds in our database with EXPD holdings at the end of the previous quarter. Our calculations also showed that EXPD isn’t among the 30 most popular stocks among hedge funds.

Today there are a large number of formulas stock market investors employ to appraise stocks. Some of the less utilized formulas are hedge fund and insider trading activity. We have shown that, historically, those who follow the best picks of the best investment managers can outperform the market by a healthy margin (see the details here).

Let’s take a glance at the new hedge fund action encompassing Expeditors International of Washington, Inc. (NASDAQ:EXPD).

What does the smart money think about Expeditors International of Washington, Inc. (NASDAQ:EXPD)?

Heading into the fourth quarter of 2018, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -21% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards EXPD over the last 13 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Select Equity Group held the most valuable stake in Expeditors International of Washington, Inc. (NASDAQ:EXPD), which was worth $321.2 million at the end of the third quarter. On the second spot was AQR Capital Management which amassed $89.9 million worth of shares. Moreover, International Value Advisers, Tensile Capital, and Gotham Asset Management were also bullish on Expeditors International of Washington, Inc. (NASDAQ:EXPD), allocating a large percentage of their portfolios to this stock.

Because Expeditors International of Washington, Inc. (NASDAQ:EXPD) has faced falling interest from the aggregate hedge fund industry, it’s safe to say that there was a specific group of fund managers who were dropping their positions entirely last quarter. Intriguingly, Israel Englander’s Millennium Management cut the biggest investment of the “upper crust” of funds watched by Insider Monkey, worth close to $52.4 million in stock. Jim Simons’s fund, Renaissance Technologies, also said goodbye to its stock, about $29.1 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest was cut by 6 funds last quarter.

Let’s also examine hedge fund activity in other stocks similar to Expeditors International of Washington, Inc. (NASDAQ:EXPD). These stocks are International Flavors & Fragrances Inc (NYSE:IFF), Elanco Animal Health Incorporated (NYSE:ELAN), Norwegian Cruise Line Holdings Ltd (NYSE:NCLH), and CF Industries Holdings, Inc. (NYSE:CF). All of these stocks’ market caps match EXPD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IFF | 22 | 412418 | 1 |

| ELAN | 36 | 368441 | 36 |

| NCLH | 41 | 1012743 | 12 |

| CF | 33 | 1162426 | 3 |

| Average | 33 | 739007 | 13 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33 hedge funds with bullish positions and the average amount invested in these stocks was $739 million. That figure was $710 million in EXPD’s case. Norwegian Cruise Line Holdings Ltd (NYSE:NCLH) is the most popular stock in this table. On the other hand International Flavors & Fragrances Inc (NYSE:IFF) is the least popular one with only 22 bullish hedge fund positions. Compared to these stocks Expeditors International of Washington, Inc. (NASDAQ:EXPD) is even less popular than IFF. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.