We started seeing tectonic shifts in the market during the third quarter. Small-cap stocks underperformed the large-cap stocks by more than 10 percentage points between the end of June 2015 and the end of June 2016. A mean reversion in trends bumped small-cap stocks’ return to almost 9% in Q3, outperforming their large-cap peers by 5 percentage points. The momentum in small-cap space hasn’t subsided during this quarter either. Small-cap stocks beat large-cap stocks by another 5 percentage points during the first 7 weeks of this quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were boosting their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards E*TRADE Financial Corp (NASDAQ:ETFC) .

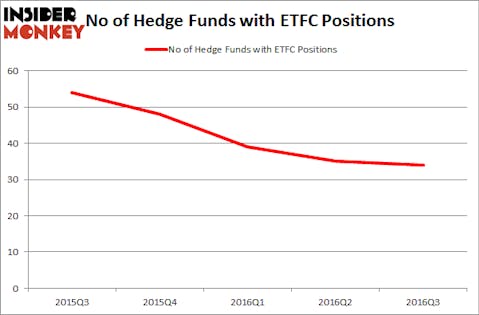

E*TRADE Financial Corp (NASDAQ:ETFC) has experienced a decrease in enthusiasm from smart money of late. ETFC was in 34 hedge funds’ portfolios at the end of September. There were 35 hedge funds in our database with ETFC holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Everest Re Group Ltd (NYSE:RE), Msci Inc (NYSE:MSCI), and Michael Kors Holdings Ltd (NYSE:KORS) to gather more data points.

Follow E Trade Financial Corp (NASDAQ:ETFC)

Follow E Trade Financial Corp (NASDAQ:ETFC)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year, involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs.

With all of this in mind, let’s view the recent action encompassing E*TRADE Financial Corp (NASDAQ:ETFC).

How have hedgies been trading E*TRADE Financial Corp (NASDAQ:ETFC)?

At Q3’s end, a total of 34 of the hedge funds tracked by Insider Monkey held long positions in this stock, a drop of 3% from the second quarter of 2016. On the other hand, there were a total of 48 hedge funds with a bullish position in ETFC at the beginning of this year. With hedgies’ capital changing hands, there exists a select group of key hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Ken Griffin’s Citadel Investment Group has the number one position in E*TRADE Financial Corp (NASDAQ:ETFC), worth close to $214.5 million, accounting for 0.2% of its total 13F portfolio. The second largest stake is held by Southpoint Capital Advisors, led by John Smith Clark, which holds a $170.4 million position; 7.6% of its 13F portfolio is allocated to the company. Some other professional money managers that hold long positions encompass Glenn J. Krevlin’s Glenhill Advisors, Israel Englander’s Millennium Management and Alan Fournier’s Pennant Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Judging by the fact that E*TRADE Financial Corp (NASDAQ:ETFC) has encountered a decline in interest from the aggregate hedge fund industry, we can see that there is a sect of funds that slashed their positions entirely heading into Q4. It’s worth mentioning that Jacob Gottlieb’s Visium Asset Management said goodbye to the biggest investment of the “upper crust” of funds followed by Insider Monkey, totaling an estimated $9.3 million in stock. Dmitry Balyasny’s fund, Balyasny Asset Management, also dropped its call options, about $5.6 million worth of ETFC shares.

Let’s go over hedge fund activity in other stocks similar to E*TRADE Financial Corp (NASDAQ:ETFC). These stocks are Everest Re Group Ltd (NYSE:RE), Msci Inc (NYSE:MSCI), Michael Kors Holdings Ltd (NYSE:KORS), and Coty Inc (NYSE:COTY). This group of stocks’ market caps resemble ETFC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RE | 18 | 656448 | -4 |

| MSCI | 24 | 349907 | 1 |

| KORS | 31 | 583806 | 2 |

| COTY | 46 | 3034196 | 33 |

As you can see these stocks had an average of 30 hedge funds with bullish positions and the average amount invested in these stocks was $1.16 billion. That figure was $1.08 billion in ETFC’s case. Coty Inc (NYSE:COTY) is the most popular stock in this table. On the other hand Everest Re Group Ltd (NYSE:RE) is the least popular one with only 18 bullish hedge fund positions. E*TRADE Financial Corp (NASDAQ:ETFC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard COTY might be a better candidate to consider taking a long position in.

Disclosure: none.