In this article we are going to use hedge fund sentiment as a tool and determine whether Ecolab Inc. (NYSE:ECL) is a good investment right now. We like to analyze hedge fund sentiment before conducting days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

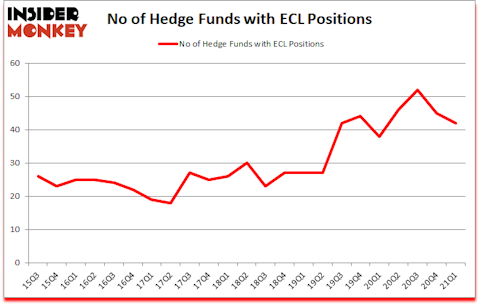

Is ECL a good stock to buy? Ecolab Inc. (NYSE:ECL) was in 42 hedge funds’ portfolios at the end of March. The all time high for this statistic is 52. ECL investors should pay attention to a decrease in support from the world’s most elite money managers lately. There were 45 hedge funds in our database with ECL holdings at the end of December. Our calculations also showed that ECL isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

Today there are numerous formulas stock traders have at their disposal to grade publicly traded companies. Some of the most underrated formulas are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the best picks of the elite investment managers can outperform the market by a very impressive amount (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

William Von Mueffling of Cantillon Capital Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation, which is why we are checking out this inflation play. We go through lists like 10 best gold stocks to buy to identify promising stocks. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind we’re going to analyze the latest hedge fund action surrounding Ecolab Inc. (NYSE:ECL).

Do Hedge Funds Think ECL Is A Good Stock To Buy Now?

At the end of March, a total of 42 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -7% from the fourth quarter of 2020. Below, you can check out the change in hedge fund sentiment towards ECL over the last 23 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Michael Larson’s Bill & Melinda Gates Foundation Trust has the biggest position in Ecolab Inc. (NYSE:ECL), worth close to $934.7 million, amounting to 4.5% of its total 13F portfolio. Sitting at the No. 2 spot is Impax Asset Management, managed by Ian Simm, which holds a $552.1 million position; 2.8% of its 13F portfolio is allocated to the company. Some other professional money managers that hold long positions comprise William von Mueffling’s Cantillon Capital Management, Cliff Asness’s AQR Capital Management and Tom Gayner’s Markel Gayner Asset Management. In terms of the portfolio weights assigned to each position Columbus Point allocated the biggest weight to Ecolab Inc. (NYSE:ECL), around 5.88% of its 13F portfolio. Bill & Melinda Gates Foundation Trust is also relatively very bullish on the stock, setting aside 4.46 percent of its 13F equity portfolio to ECL.

Due to the fact that Ecolab Inc. (NYSE:ECL) has experienced a decline in interest from the smart money, it’s easy to see that there exists a select few fund managers that elected to cut their entire stakes by the end of the first quarter. At the top of the heap, Mikal Patel’s Oribel Capital Management dropped the biggest stake of all the hedgies watched by Insider Monkey, totaling about $7.2 million in stock. Michael Cowley’s fund, Sandbar Asset Management, also cut its stock, about $5.3 million worth. These transactions are important to note, as total hedge fund interest dropped by 3 funds by the end of the first quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Ecolab Inc. (NYSE:ECL) but similarly valued. We will take a look at Dominion Energy Inc. (NYSE:D), Autodesk, Inc. (NASDAQ:ADSK), NIO Inc. (NYSE:NIO), Equinix Inc (NASDAQ:EQIX), Workday Inc (NYSE:WDAY), Global Payments Inc (NYSE:GPN), and Banco Santander, S.A. (NYSE:SAN). This group of stocks’ market values are closest to ECL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| D | 39 | 1295937 | -8 |

| ADSK | 66 | 3056525 | 0 |

| NIO | 28 | 1321170 | -6 |

| EQIX | 41 | 1546339 | -1 |

| WDAY | 69 | 5179677 | -11 |

| GPN | 62 | 4558094 | 7 |

| SAN | 15 | 490548 | 1 |

| Average | 45.7 | 2492613 | -2.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 45.7 hedge funds with bullish positions and the average amount invested in these stocks was $2493 million. That figure was $2403 million in ECL’s case. Workday Inc (NYSE:WDAY) is the most popular stock in this table. On the other hand Banco Santander, S.A. (NYSE:SAN) is the least popular one with only 15 bullish hedge fund positions. Ecolab Inc. (NYSE:ECL) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for ECL is 51.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 17.4% in 2021 through June 18th and surpassed the market again by 6.1 percentage points. Unfortunately ECL wasn’t nearly as popular as these 5 stocks (hedge fund sentiment was quite bearish); ECL investors were disappointed as the stock returned -4% since the end of March (through 6/18) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2021.

Follow Ecolab Inc. (NYSE:ECL)

Follow Ecolab Inc. (NYSE:ECL)

Receive real-time insider trading and news alerts

Suggested Articles:

- How to Best Use Insider Monkey To Increase Your Returns

- 20 Most Cultured Cities In the US

- 15 Largest Spice Companies in the World

Disclosure: None. This article was originally published at Insider Monkey.