Hedge fund managers like David Einhorn, Dan Loeb, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: Diamondback Energy Inc (NASDAQ:FANG).

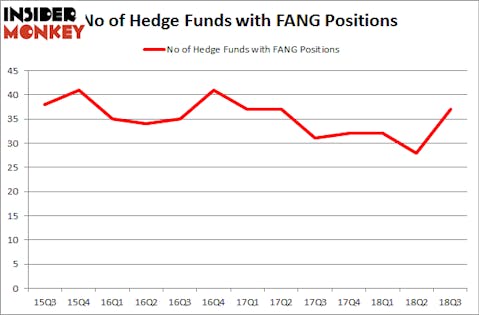

Diamondback Energy Inc (NASDAQ:FANG) shareholders have witnessed an increase in enthusiasm from smart money of late. FANG was in 37 hedge funds’ portfolios at the end of September. There were 28 hedge funds in our database with FANG positions at the end of the previous quarter. Our calculations also showed that FANG isn’t among the 30 most popular stocks among hedge funds.

According to most shareholders, hedge funds are viewed as unimportant, old financial tools of years past. While there are over 8,000 funds in operation today, Our researchers look at the top tier of this club, about 700 funds. These hedge fund managers command most of the smart money’s total asset base, and by observing their inimitable equity investments, Insider Monkey has found a number of investment strategies that have historically surpassed Mr. Market. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by 6 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s take a look at the fresh hedge fund action encompassing Diamondback Energy Inc (NASDAQ:FANG).

How have hedgies been trading Diamondback Energy Inc (NASDAQ:FANG)?

Heading into the fourth quarter of 2018, a total of 37 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 32% from one quarter earlier. By comparison, 32 hedge funds held shares or bullish call options in FANG heading into this year. With hedgies’ capital changing hands, there exists a select group of notable hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

Among these funds, Citadel Investment Group held the most valuable stake in Diamondback Energy Inc (NASDAQ:FANG), which was worth $291.6 million at the end of the third quarter. On the second spot was Wexford Capital which amassed $116.5 million worth of shares. Moreover, Two Creeks Capital Management, Columbus Circle Investors, and Brenham Capital Management were also bullish on Diamondback Energy Inc (NASDAQ:FANG), allocating a large percentage of their portfolios to this stock.

Now, key hedge funds have jumped into Diamondback Energy Inc (NASDAQ:FANG) headfirst. Wexford Capital, managed by Charles Davidson and Joseph Jacobs, created the most outsized position in Diamondback Energy Inc (NASDAQ:FANG). Wexford Capital had $116.5 million invested in the company at the end of the quarter. John Labanowski’s Brenham Capital Management also initiated a $70.3 million position during the quarter. The following funds were also among the new FANG investors: Dan Loeb’s Third Point, Zach Schreiber’s Point State Capital, and Jorge Paulo Lemann’s 3G Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Diamondback Energy Inc (NASDAQ:FANG) but similarly valued. These stocks are Alexandria Real Estate Equities Inc (NYSE:ARE), Conagra Brands, Inc. (NYSE:CAG), Rollins, Inc. (NYSE:ROL), and Wayfair Inc (NYSE:W). This group of stocks’ market valuations are closest to FANG’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ARE | 18 | 354276 | -5 |

| CAG | 38 | 1060012 | 7 |

| ROL | 17 | 287432 | 1 |

| W | 30 | 1549111 | 0 |

| Average | 25.75 | 812708 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.75 hedge funds with bullish positions and the average amount invested in these stocks was $813 million. That figure was $1.33 billion in FANG’s case. Conagra Brands, Inc. (NYSE:CAG) is the most popular stock in this table. On the other hand Rollins, Inc. (NYSE:ROL) is the least popular one with only 17 bullish hedge fund positions. Diamondback Energy Inc (NASDAQ:FANG) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CAG might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.