With Apple Inc. (NASDAQ:AAPL)‘s annual shareholder meeting coming up next week, investors are likely to focus primarily on Apple’s cash problem. It’s a good problem to have too much money, but in this case it’s still a problem nonetheless.

Ahead of the meeting, Apple Inc. (NASDAQ:AAPL) is wrangling with hedge fund investor David Einhorn, whose Greenlight Capital holds 1.3 million shares of the company. Einhorn boosted his fund’s holdings in the Mac maker by 216,000 shares, or 20%, during the fourth quarter, and is now butting heads with management over the bundling of a proposal in Apple’s proxy. Ultimately, Einhorn would like to see Apple Inc. (NASDAQ:AAPL) issue high-yielding perpetual preferred shares as a clever way to give more back to shareholders.

Einhorn’s on to something

For what it’s worth, one analyst has Einhorn’s back. Topeka Capital Markets analyst Brian White said today that Apple needs to “seize the opportunity” and return significantly more cash back to investors. White doesn’t think that Einhorn is dead set on his preferred stock idea, but it’s just one of several ways that Apple Inc. (NASDAQ:AAPL) can reduce its cash balance for the benefit of shareholders.

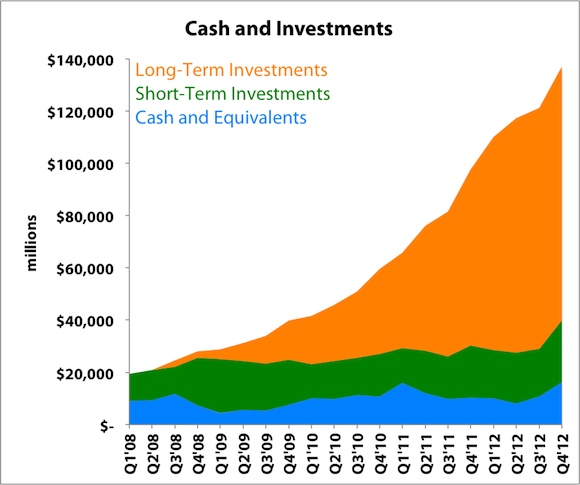

Source: SEC filings. Calendar quarters shown.

White is also the Street analyst that seems intent to keep the highest price target on Apple at all times. He previously had a target of $1,111, but has now moved that figure down to $888 to accommodate for the recent weakness.

Too much, too fast

By White’s estimates, Apple Inc. (NASDAQ:AAPL)’s cash balance could easily balloon to an even more absurd level of $241 billion by 2015 at the current rate unless the Mac maker changes its hoarding ways. To put that figure into context, that would be more than Microsoft Corporation (NASDAQ:MSFT)‘s entire current market cap — just sitting around as cash.

We already know that Apple’s money mountain isn’t earning a whole lot, in part because it’s goal is capital preservation. It’s also putting a drag on some of Apple Inc. (NASDAQ:AAPL)’s ratios regarding management effectiveness, such as return on equity and return on assets.

Bring the cash back home?

The bigger hurdle is that most of those dollars are stuck overseas due to hefty repatriation taxes. After the repatriation tax holiday in 2004 set a precedent, companies have continued to hold out in the hopes that another holiday would eventually see the light of day. Nearly a year ago, Apple said it was lobbying for another such holiday, but lawmakers don’t seem interested.

Source: SEC filings. Calendar quarters shown.

As it stands, $94.2 billion (69% of total cash) is stuck overseas and cannot be returned to shareholders. This is one reason why Einhorn’s idea is appealing: because Apple could fund it with domestic cash.