The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge funds have been producing disappointing net returns in recent years, however that was partly due to the poor performance of small-cap stocks in general. Well, small-cap stocks finally turned the corner and have been beating the large-cap stocks by more than 10 percentage points over the last 5 months.This means the relevancy of hedge funds’ public filings became inarguable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards CVB Financial Corp. (NASDAQ:CVBF).

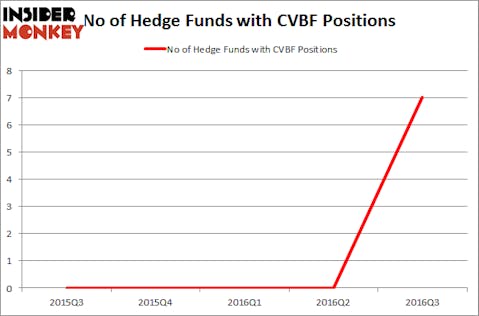

Is CVB Financial Corp. (NASDAQ:CVBF) a good investment right now? Money managers are genuinely getting more optimistic. The number of long hedge fund investments swelled by 7 lately. There were no hedge funds in our database with CVBF positions at the end of the previous quarter. At the end of this article we will also compare CVBF to other stocks including Old National Bancorp (NYSE:ONB), Columbia Banking System Inc (NASDAQ:COLB), and El Paso Electric Company (NYSE:EE) to get a better sense of its popularity.

Follow Cvb Financial Corp (NASDAQ:CVBF)

Follow Cvb Financial Corp (NASDAQ:CVBF)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Kevin George/Shutterstock.com

What does the smart money think about CVB Financial Corp. (NASDAQ:CVBF)?

As stated earlier, at Q3’s end, a total of 7 of the hedge funds tracked by Insider Monkey held long positions in this stock. Below, you can check out the change in hedge fund sentiment towards CVBF over the last 5 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Ken Fisher’s Fisher Asset Management has the largest position in CVB Financial Corp. (NASDAQ:CVBF), worth close to $2.9 million. Coming in second is Ellington, led by Mike Vranos, holding a $0.8 million position. Other peers with similar optimism consist of Ken Griffin’s Citadel Investment Group, Paul Tudor Jones’ Tudor Investment Corp and Cliff Asness’s AQR Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

With a general bullishness amongst the heavyweights, key money managers were leading the bulls’ herd. Ellington established the biggest position in CVB Financial Corp. (NASDAQ:CVBF). Citadel Investment Group also made a $0.5 million investment in the stock during the quarter. The other funds with brand new CVBF positions are John Overdeck and David Siegel’s Two Sigma Advisors, and Matthew Tewksbury’s Stevens Capital Management.

Let’s check out hedge fund activity in other stocks similar to CVB Financial Corp. (NASDAQ:CVBF). We will take a look at Old National Bancorp (NYSE:ONB), Columbia Banking System Inc (NASDAQ:COLB), El Paso Electric Company (NYSE:EE), and Cosan Limited (USA) (NYSE:CZZ). This group of stocks’ market valuations match CVBF’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ONB | 9 | 28142 | 0 |

| COLB | 6 | 83231 | -4 |

| EE | 9 | 141784 | -3 |

| CZZ | 23 | 168854 | 7 |

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $106 million. That figure was $5 million in CVBF’s case. Cosan Limited (USA) (NYSE:CZZ) is the most popular stock in this table. On the other hand Columbia Banking System Inc (NASDAQ:COLB) is the least popular one with only 6 bullish hedge fund positions. CVB Financial Corp. (NASDAQ:CVBF) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CZZ might be a better candidate to consider taking a long position in.

Disclosure: None