Does Crown Holdings, Inc. (NYSE:CCK) represent a good buying opportunity at the moment? Let’s briefly check the hedge fund sentiment towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail unconceivably on some occasions, but their stock picks have been generating superior risk-adjusted returns on average over the years.

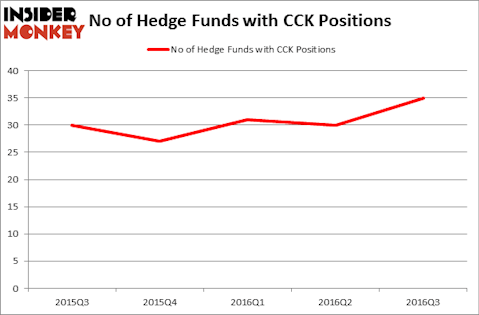

Crown Holdings, Inc. (NYSE:CCK) was in 35 hedge funds’ portfolios at the end of the third quarter of 2016. CCK has seen an increase in support from the world’s most elite money managers lately. There were 30 hedge funds in our database with CCK holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Qorvo Inc (NASDAQ:QRVO), HD Supply Holdings Inc (NASDAQ:HDS), and KT Corporation (ADR) (NYSE:KT) to gather more data points.

Follow Crown Holdings Inc. (NYSE:CCK)

Follow Crown Holdings Inc. (NYSE:CCK)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Borkin Vadim/Shutterstock.com

What does the smart money think about Crown Holdings, Inc. (NYSE:CCK)?

At Q3’s end, a total of 35 of the hedge funds tracked by Insider Monkey held long positions in this stock, an increase of 17% from the previous quarter, pushing ownership among hedgies to a yearly high. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Phill Gross and Robert Atchinson’s Adage Capital Management has the number one position in Crown Holdings, Inc. (NYSE:CCK), worth close to $172.8 million. Sitting at the No. 2 spot is Cliff Asness of AQR Capital Management, with a $114.4 million position. Some other hedge funds and institutional investors that hold long positions encompass D E Shaw, John Osterweis’ Osterweis Capital Management, and Israel Englander’s Millennium Management.

Now, specific money managers were leading the bulls’ herd. Partner Fund Management, managed by Christopher James, initiated the most outsized position in Crown Holdings, Inc. (NYSE:CCK). The fund had $32 million invested in the company at the end of the quarter. Jason Young and Alfred Geary’s YG Partners also made a $12 million investment in the stock during the quarter. The other funds with new positions in the stock are Joel Greenblatt’s Gotham Asset Management, Thomas Bailard’s Bailard Inc, and Neil Chriss’ Hutchin Hill Capital.

Let’s check out hedge fund activity in other stocks similar to Crown Holdings, Inc. (NYSE:CCK). These stocks are Qorvo Inc (NASDAQ:QRVO), HD Supply Holdings Inc (NASDAQ:HDS), KT Corporation (ADR) (NYSE:KT), and Raymond James Financial, Inc. (NYSE:RJF). This group of stocks’ market values resemble CCK’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| QRVO | 27 | 198381 | 5 |

| HDS | 40 | 1866259 | -7 |

| KT | 10 | 93403 | 2 |

| RJF | 17 | 329488 | 1 |

As you can see these stocks had an average of 24 hedge funds with bullish positions and the average amount invested in these stocks was $622 million. That figure was $706 million in CCK’s case. HD Supply Holdings Inc (NASDAQ:HDS) is the most popular stock in this table. On the other hand KT Corporation (ADR) (NYSE:KT) is the least popular one with only 10 bullish hedge fund positions. Crown Holdings, Inc. (NYSE:CCK) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds really like. In this regard HDS might be a better candidate to consider a long position in.

Disclosure: None