Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips on the charts, usually don’t make them change their opinion towards a company. The second half of 2015 and the first few months of this year was a stressful period for hedge funds. However, things have been taking a turn for the better in the second half of this year. Small-cap stocks which hedge funds are usually overweight outperformed the market by double digits and it may be a good time to pay attention to hedge funds’ picks before it is too late. In this article we are going to analyze the hedge fund sentiment towards Costco Wholesale Corporation (NASDAQ:COST) to find out whether it was one of their high conviction long-term ideas.

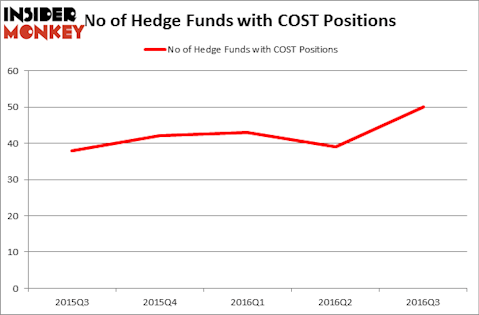

So, is Costco Wholesale Corporation (NASDAQ:COST) a buy, sell, or hold? The best stock pickers seem to be becoming more confident. The number of long hedge fund positions rose by 11 to 50 during the third quarter. However, the level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as BHP Billiton plc (ADR) (NYSE:BBL), Simon Property Group, Inc (NYSE:SPG), and Colgate-Palmolive Company (NYSE:CL) to gather more data points.

Follow Costco Wholesale Corp W (NASDAQ:COST)

Follow Costco Wholesale Corp W (NASDAQ:COST)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Niloo / Shutterstock.com

Now, let’s take a peek at the recent action surrounding Costco Wholesale Corporation (NASDAQ:COST).

How have hedgies been trading Costco Wholesale Corporation (NASDAQ:COST)?

A total of 50 funds tracked by Insider Monkey were bullish on this stock at the end of September, an increase of 28% over the quarter. With the smart money’s sentiment swirling, there exists an “upper tier” of key hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Warren Buffett’s Berkshire Hathaway has the number one position in Costco Wholesale Corporation (NASDAQ:COST), worth close to $660.9 million, comprising 0.5% of its total 13F portfolio. The second most bullish fund manager is Jim Simons’ Renaissance Technologies, with a $318.2 million position; the fund has 0.6% of its 13F portfolio invested in the stock. Remaining members of the smart money that are bullish contain Ken Griffin’s Citadel Investment Group, Panayotis Takis Sparaggis’ Alkeon Capital Management, and Richard Chilton’s Chilton Investment Company.

Now, specific money managers have jumped into Costco Wholesale Corporation (NASDAQ:COST) headfirst. Highfields Capital Management, led by Jonathon Jacobson, assembled the biggest position in Costco Wholesale Corporation (NASDAQ:COST). Highfields Capital Management had $66.5 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also initiated a $63.1 million position during the quarter. The other funds with new positions in the stock are Alexander Mitchell’s Scopus Asset Management, Ken Griffin’s Citadel Investment Group, and Gabriel Plotkin’s Melvin Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Costco Wholesale Corporation (NASDAQ:COST) but similarly valued. We will take a look at BHP Billiton plc (ADR) (NYSE:BBL), Simon Property Group, Inc (NYSE:SPG), Colgate-Palmolive Company (NYSE:CL), and Texas Instruments Incorporated (NASDAQ:TXN). This group of stocks’ market values are similar to COST’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BBL | 18 | 323894 | -1 |

| SPG | 20 | 893010 | -1 |

| CL | 38 | 1877260 | 2 |

| TXN | 37 | 943996 | 6 |

As you can see these stocks had an average of 28 investors with bullish positions and the average amount invested in these stocks was $1.01 billion. That figure was $2.38 billion in COST’s case. Colgate-Palmolive Company (NYSE:CL) is the most popular stock in this table with 38 investors holding shares. On the other hand BHP Billiton plc (ADR) (NYSE:BBL) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Costco Wholesale Corporation (NASDAQ:COST) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.