Hedge funds run by legendary names like Nelson Peltz and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant out-performance. These stocks have been on a tear since the end of June, outperforming large-cap index funds by more than 10 percentage points. That’s why we pay special attention to hedge fund activity in these stocks.

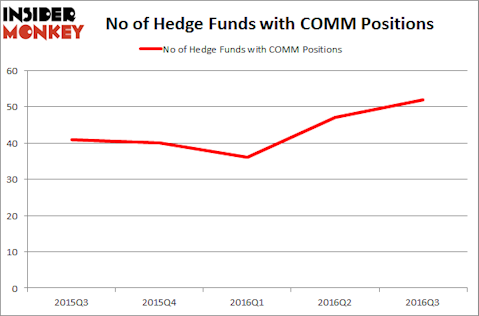

Commscope Holding Company Inc (NASDAQ:COMM) has seen an increase in hedge fund sentiment recently, as the number of funds holding shares of it has jumped by five. At the end of this article we will also compare COMM to other stocks including Owens Corning (NYSE:OC), Sensata Technologies Holding N.V. (NYSE:ST), and Macquarie Infrastructure Company LLC (NYSE:MIC) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Copyright: rawpixel / 123RF Stock Photo

With all of this in mind, we’re going to view the fresh action surrounding Commscope Holding Company Inc (NASDAQ:COMM).

What have hedge funds been doing with Commscope Holding Company Inc (NASDAQ:COMM)?

At Q3’s end, a total of 52 of the hedge funds tracked by Insider Monkey held long positions in this stock, a rise of 11% from the second quarter of 2016 and more than 30% over the past two quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of key hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Lee Ainslie’s Maverick Capital has the largest position in Commscope Holding Company Inc (NASDAQ:COMM), worth close to $496.8 million, accounting for 5.9% of its total 13F portfolio. The second most bullish fund manager is John Shapiro of Chieftain Capital, with a $460.7 million position; the fund has a massive 26.6% of its 13F portfolio invested in the stock. Remaining members of the smart money that hold long positions include Bob Peck and Andy Raab’s FPR Partners, William Duhamel’s Route One Investment Company and Keith Meister’s Corvex Capital.

As industry-wide interest jumped, key hedge funds were breaking ground themselves. Glenhill Advisors, managed by Glenn J. Krevlin, established the most outsized position in Commscope Holding Company Inc (NASDAQ:COMM). Glenhill Advisors had $20.6 million invested in the company at the end of the quarter. Eric Bannasch’s Cadian Capital also initiated a $19.1 million position during the quarter. The other funds with brand new COMM positions are Ricky Sandler’s Eminence Capital, Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners, and Daniel S. Och’s OZ Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Commscope Holding Company Inc (NASDAQ:COMM) but similarly valued. We will take a look at Owens Corning (NYSE:OC), Sensata Technologies Holding N.V. (NYSE:ST), Macquarie Infrastructure Company LLC (NYSE:MIC), and United Rentals, Inc. (NYSE:URI). All of these stocks’ market caps are closest to COMM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OC | 35 | 1197532 | 1 |

| ST | 27 | 1392748 | -1 |

| MIC | 45 | 1058126 | -2 |

| URI | 43 | 539688 | 6 |

As you can see these stocks had an average of 37.5 hedge funds with bullish positions and the average amount invested in these stocks was $1.05 billion. That figure was $2.89 billion in COMM’s case. Macquarie Infrastructure Company LLC (NYSE:MIC) is the most popular stock in this table. On the other hand Sensata Technologies Holding N.V. (NYSE:ST) is the least popular one with only 27 bullish hedge fund positions. Compared to these stocks Commscope Holding Company Inc (NASDAQ:COMM) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers and that more and more hedge funds are becoming shareholders of it, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None