Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of September. At Insider Monkey, we follow nearly 900 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Commscope Holding Company Inc (NASDAQ:COMM), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

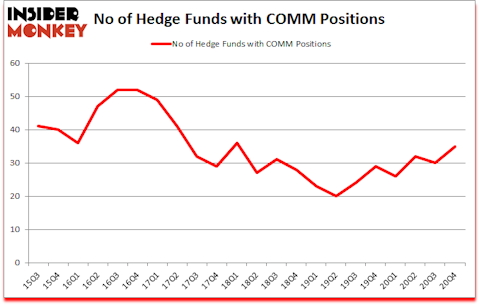

Is COMM stock a buy? Commscope Holding Company Inc (NASDAQ:COMM) has seen an increase in support from the world’s most elite money managers recently. Commscope Holding Company Inc (NASDAQ:COMM) was in 35 hedge funds’ portfolios at the end of December. The all time high for this statistic is 52. There were 30 hedge funds in our database with COMM holdings at the end of September. Our calculations also showed that COMM isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 124 percentage points since March 2017 (see the details here). At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the House passed a landmark bill decriminalizing marijuana. So, we are checking out this under the radar cannabis stock right now. We go through lists like the 10 best battery stocks to buy to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. With all of this in mind we’re going to take a peek at the recent hedge fund action regarding Commscope Holding Company Inc (NASDAQ:COMM).

Do Hedge Funds Think COMM Is A Good Stock To Buy Now?

Heading into the first quarter of 2021, a total of 35 of the hedge funds tracked by Insider Monkey were long this stock, a change of 17% from one quarter earlier. By comparison, 29 hedge funds held shares or bullish call options in COMM a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Bob Peck and Andy Raab’s FPR Partners has the largest position in Commscope Holding Company Inc (NASDAQ:COMM), worth close to $220.5 million, corresponding to 6.5% of its total 13F portfolio. Sitting at the No. 2 spot is Lyrical Asset Management, managed by Andrew Wellington and Jeff Keswin, which holds a $123.6 million position; 1.7% of its 13F portfolio is allocated to the stock. Other hedge funds and institutional investors that are bullish encompass Phill Gross and Robert Atchinson’s Adage Capital Management, Jerry Kochanski’s Shelter Haven Capital Management and Rob Citrone’s Discovery Capital Management. In terms of the portfolio weights assigned to each position Shelter Haven Capital Management allocated the biggest weight to Commscope Holding Company Inc (NASDAQ:COMM), around 13.52% of its 13F portfolio. FPR Partners is also relatively very bullish on the stock, setting aside 6.49 percent of its 13F equity portfolio to COMM.

Now, some big names were breaking ground themselves. GoldenTree Asset Management, managed by Steven Tananbaum, established the biggest position in Commscope Holding Company Inc (NASDAQ:COMM). GoldenTree Asset Management had $24.5 million invested in the company at the end of the quarter. Baker Burleson and Stormy Scott’s Banbury Partners also made a $12.1 million investment in the stock during the quarter. The other funds with brand new COMM positions are William Harnisch’s Peconic Partners LLC, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, and Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners.

Let’s now review hedge fund activity in other stocks similar to Commscope Holding Company Inc (NASDAQ:COMM). These stocks are Utz Brands Inc (NYSE:UTZ), LGI Homes Inc (NASDAQ:LGIH), Arcosa, Inc. (NYSE:ACA), Opko Health Inc. (NASDAQ:OPK), Ameris Bancorp (NASDAQ:ABCB), CVB Financial Corp. (NASDAQ:CVBF), and United States Cellular Corporation (NYSE:USM). This group of stocks’ market valuations are similar to COMM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UTZ | 15 | 101186 | 0 |

| LGIH | 23 | 90560 | -2 |

| ACA | 17 | 216350 | -2 |

| OPK | 16 | 20591 | 5 |

| ABCB | 18 | 99769 | 5 |

| CVBF | 11 | 29995 | -2 |

| USM | 11 | 88794 | -2 |

| Average | 15.9 | 92464 | 0.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.9 hedge funds with bullish positions and the average amount invested in these stocks was $92 million. That figure was $644 million in COMM’s case. LGI Homes Inc (NASDAQ:LGIH) is the most popular stock in this table. On the other hand CVB Financial Corp. (NASDAQ:CVBF) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Commscope Holding Company Inc (NASDAQ:COMM) is more popular among hedge funds. Our overall hedge fund sentiment score for COMM is 80.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks returned 7.9% in 2021 through April 1st but still managed to beat the market by 0.4 percentage points. Hedge funds were also right about betting on COMM as the stock returned 16.2% since the end of December (through 4/1) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Commscope Holding Company Inc. (NASDAQ:COMM)

Follow Commscope Holding Company Inc. (NASDAQ:COMM)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.