Carillon Tower Advisers, an investment management firm, published its “Carillon Eagle Small Cap Growth Fund” fourth quarter 2021 investor letter – a copy of which can be downloaded here. Small-cap stocks overall posted minor gains in the final quarter of 2021. In what has become a common theme, the Russell 2000® Growth Index (up 0.02%) trailed its Russell 2000® Value Index (up 4.36%) counterpart for the fifth consecutive quarter. Sector returns across the Russell 2000 Growth Index were mostly positive, with the defensively oriented utilities (up 14.18%) and real estate (up 13.94%) sectors leading the way. Industrials (up 9.73%), financials (up 9.05%), and consumer staples (up 5.67%) also provided returns that outpaced the benchmark. Spare some time to check the fund’s top 5 holdings to have a clue about their top bets for 2022.

Carillon Eagle Small Cap Growth Fund, in its Q4 2021 investor letter, mentioned CMC Materials, Inc. (NASDAQ: CCMP) and discussed its stance on the firm. CMC Materials, Inc. is an Aurora, Illinois-based semiconductor company with a $5.3 billion market capitalization. CCMP delivered a -2.77% return since the beginning of the year, while its 12-month returns are up by 6.60%. The stock closed at $186.38 per share on February 10, 2022.

Here is what Carillon Eagle Small Cap Growth Fund has to say about CMC Materials, Inc. in its Q4 2021 investor letter:

“CMC Materials supplies consumable materials used in semiconductor chip production as well as oil pipelines. Shares rose after it was announced the firm had reached an agreement to be acquired by a materials sciences company that is another of the fund’s holdings in a cash and stock deal valuing the company at a healthy premium to the prior close price. We believe this acquisition makes a lot of sense given the increasing importance of critical chemicals used by chip makers at smaller nodes.”

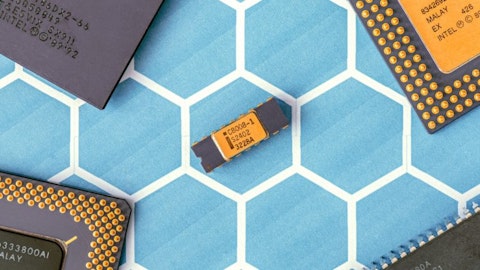

jonas-svidras-e28-krnIVmo-unsplash

Our calculations show that CMC Materials, Inc. (NASDAQ: CCMP) failed to obtain a mark on our list of the 30 Most Popular Stocks Among Hedge Funds. CCMP was in 22 hedge fund portfolios at the end of the third quarter of 2021, compared to 22 funds in the previous quarter. CMC Materials, Inc. (NASDAQ: CCMP) delivered a 28.59% return in the past 3 months.

In November 2021, we also shared another hedge fund’s views on CCMP in another article. You can find other letters from hedge funds and prominent investors on our hedge fund investor letters 2021 Q4 page.

Disclosure: None. This article is originally published at Insider Monkey.