As we already know from media reports and hedge fund investor letters, hedge funds delivered their best returns in a decade. Most investors who decided to stick with hedge funds after a rough 2018 recouped their losses by the end of the fourth quarter of 2019. A significant number of hedge funds continued their strong performance in 2020 and 2021 as well. We get to see hedge funds’ thoughts towards the market and individual stocks by aggregating their quarterly portfolio movements and reading their investor letters. In this article, we will particularly take a look at what hedge funds think about Cerevel Therapeutics Holdings, Inc. (NASDAQ:CERE).

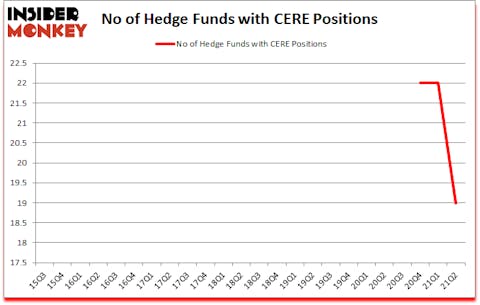

Is Cerevel Therapeutics Holdings, Inc. (NASDAQ:CERE) a buy, sell, or hold? Prominent investors were selling. The number of long hedge fund positions were cut by 3 recently. Cerevel Therapeutics Holdings, Inc. (NASDAQ:CERE) was in 19 hedge funds’ portfolios at the end of June. The all time high for this statistic is 22. Our calculations also showed that CERE isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 79 percentage points since March 2017 (see the details here). That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

With all of this in mind let’s check out the recent hedge fund action regarding Cerevel Therapeutics Holdings, Inc. (NASDAQ:CERE).

Do Hedge Funds Think CERE Is A Good Stock To Buy Now?

At second quarter’s end, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -14% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in CERE over the last 24 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Perceptive Advisors, managed by Joseph Edelman, holds the biggest position in Cerevel Therapeutics Holdings, Inc. (NASDAQ:CERE). Perceptive Advisors has a $119 million position in the stock, comprising 1.5% of its 13F portfolio. On Perceptive Advisors’s heels is Panayotis Takis Sparaggis of Alkeon Capital Management, with a $67.8 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Some other members of the smart money that are bullish contain Peter Kolchinsky’s RA Capital Management, Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management and Anand Parekh’s Alyeska Investment Group. In terms of the portfolio weights assigned to each position Perceptive Advisors allocated the biggest weight to Cerevel Therapeutics Holdings, Inc. (NASDAQ:CERE), around 1.54% of its 13F portfolio. RA Capital Management is also relatively very bullish on the stock, earmarking 0.9 percent of its 13F equity portfolio to CERE.

Because Cerevel Therapeutics Holdings, Inc. (NASDAQ:CERE) has experienced a decline in interest from the entirety of the hedge funds we track, we can see that there exists a select few funds that elected to cut their full holdings last quarter. At the top of the heap, Israel Englander’s Millennium Management cut the biggest stake of the “upper crust” of funds monitored by Insider Monkey, worth about $5.8 million in stock, and Isaac Corre’s Governors Lane was right behind this move, as the fund dumped about $2.6 million worth. These moves are interesting, as aggregate hedge fund interest fell by 3 funds last quarter.

Let’s check out hedge fund activity in other stocks similar to Cerevel Therapeutics Holdings, Inc. (NASDAQ:CERE). We will take a look at Vishay Intertechnology, Inc. (NYSE:VSH), PROG Holdings Inc (NYSE:PRG), Casella Waste Systems Inc. (NASDAQ:CWST), Ingevity Corporation (NYSE:NGVT), Prospect Capital Corporation (NASDAQ:PSEC), Kontoor Brands, Inc. (NYSE:KTB), and Liberty Latin America Ltd. (NASDAQ:LILA). All of these stocks’ market caps are closest to CERE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VSH | 29 | 500383 | -3 |

| PRG | 37 | 422619 | 3 |

| CWST | 26 | 115419 | 6 |

| NGVT | 21 | 316763 | 1 |

| PSEC | 11 | 48102 | 4 |

| KTB | 23 | 186225 | 7 |

| LILA | 16 | 137765 | 2 |

| Average | 23.3 | 246754 | 2.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.3 hedge funds with bullish positions and the average amount invested in these stocks was $247 million. That figure was $359 million in CERE’s case. PROG Holdings Inc (NYSE:PRG) is the most popular stock in this table. On the other hand Prospect Capital Corporation (NASDAQ:PSEC) is the least popular one with only 11 bullish hedge fund positions. Cerevel Therapeutics Holdings, Inc. (NASDAQ:CERE) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for CERE is 43.3. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and still beat the market by 1.6 percentage points. A small number of hedge funds were also right about betting on CERE as the stock returned 57.5% since the end of the second quarter (through 10/22) and outperformed the market by an even larger margin.

Follow Cerevel Therapeutics Holdings Inc. (NASDAQ:CERE)

Follow Cerevel Therapeutics Holdings Inc. (NASDAQ:CERE)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Biggest Short Squeezes of All Time

- 10 Best Safe Blue Chip Dividend Stocks

- 15 Biggest Yogurt Companies In The World

Disclosure: None. This article was originally published at Insider Monkey.