The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Central European Media Enterprises Ltd. (NASDAQ:CETV).

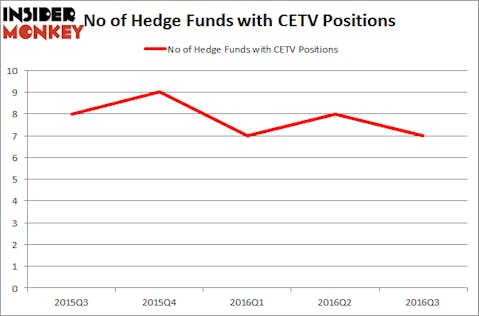

At the end of the third quarter of 2016, seven funds tracked by Insider Monkey held long positions in Central European Media Enterprises Ltd. (NASDAQ:CETV). The company registered a slight decrease in hedge fund interest between July and September. At the end of this article we will also compare CETV to other stocks including MeetMe Inc (NYSEAMEX:MEET), BioCryst Pharmaceuticals, Inc. (NASDAQ:BCRX), and Tangoe Inc (NASDAQ:TNGO) to get a better sense of its popularity.

Follow Central European Media Enterprises Ltd (NASDAQ:CETV)

Follow Central European Media Enterprises Ltd (NASDAQ:CETV)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

bluebay/Shutterstock.com

With all of this in mind, we’re going to take a gander at the new action regarding Central European Media Enterprises Ltd. (NASDAQ:CETV).

Hedge fund activity in Central European Media Enterprises Ltd. (NASDAQ:CETV)

At the end of the third quarter, a total of seven of the hedge funds tracked by Insider Monkey held long positions in this stock, down from eight funds at the end of June. Below, you can check out the change in hedge fund sentiment towards CETV over the last five quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Eric Semler’s TCS Capital Management holds the biggest position in Central European Media Enterprises Ltd. (NASDAQ:CETV). TCS Capital Management has a $41.2 million position in the stock, comprising 22.5% of its 13F portfolio. The second largest stake is held by Discovery Capital Management, led by Rob Citrone, which holds a $10.8 million position; 0.2% of its 13F portfolio is allocated to the stock. Other professional money managers that are bullish contain Michael Thompson’s BHR Capital, Allan Teh’s Kamunting Street Capital, and D E Shaw, one of the biggest hedge funds in the world. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We already know that not all hedge funds are bullish on the stock and some hedge funds actually sold off their positions entirely. Interestingly, Satyen Mehta’s Neon Liberty Capital Management sold off the biggest position of all the hedgies studied by Insider Monkey, worth close to $13.7 million in stock, and Gregory Fraser, Rudolph Kluiber, and Timothy Krochuk’s GRT Capital Partners was right behind this move, as the fund cut about $0 million worth of shares.

Let’s check out hedge fund activity in other stocks similar to Central European Media Enterprises Ltd. (NASDAQ:CETV). We will take a look at MeetMe Inc (NYSEAMEX:MEET), BioCryst Pharmaceuticals, Inc. (NASDAQ:BCRX), Tangoe Inc (NASDAQ:TNGO), and Permian Basin Royalty Trust (NYSE:PBT). This group of stocks’ market caps resemble CETV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MEET | 17 | 53543 | 3 |

| BCRX | 16 | 122719 | 1 |

| TNGO | 12 | 25577 | 1 |

| PBT | 10 | 16034 | 2 |

As you can see these stocks had an average of 14 funds with bullish positions and the average amount invested in these stocks was $54 million. That figure was $58 million in CETV’s case. MeetMe Inc (NYSEAMEX:MEET) is the most popular stock in this table. On the other hand Permian Basin Royalty Trust (NYSE:PBT) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Central European Media Enterprises Ltd. (NASDAQ:CETV) is even less popular than PBT. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None